Brazilian power market participants disagree on causes and solutions to a lack of access to power transmission lines for new projects, after mines and energy ministry (MME) gathered public comments on a new tender model this month.

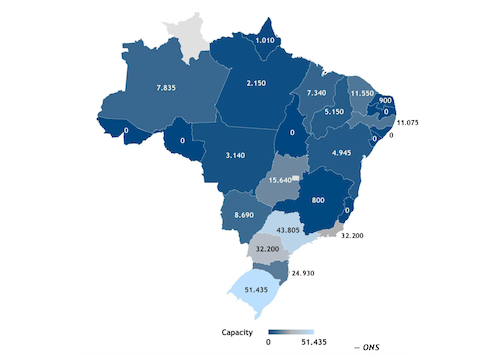

The public comment period was held as the government tries to solve the lack of transmission capacity for several new power projects. Grid operator ONS' data show that nine states have less than 1,000MW of available power generation capacity, which the wind energy association Abeeolica considers low. But some projects have been getting connection requests denied, even in locations where the data shows available transmission capacity, the association said.

The government aims to hold the first tender under the new model during the first half of 2023.

The end of renewable generation subsidies in early 2022 proved that there was a need to improve the current model for transmission line access, in which projects are queued to request permission to connect to the grid. A 2021 law ended transmission and distribution subsidies to renewable power projects authorized after March 2022. As a result, there was an abundance of new projects — caused by what the sector called a gold rush of applicants trying to avoid the deadline. The lack of access points for all new projects led to discussions about a more efficient way of granting entry into the grid.

Some generators argue that the lack of space can be traced back to solar projects not needing to pay a deposit before entering the queue, as wind and hydro plants do, which could have incentivized them to take up space in line with projects that might not come to fruition.

Electricity regulator Aneel denies any direct link between the lack of access to transmission lines and the lack of deposits, despite an increase in solar projects — which represented almost 80pc of all projects authorized in 2022. Aneel attributes the increase instead to solar projects being less expensive to build, arguing the deposits represent too low of a value to make a difference.

Power transmission companies' association Abrate says that the tender model is the only solution for the lack of transmission capacity. The association adds that the gold rush to avoid tariffs created the lack of access to lines and argues for permanent regulation limiting the scope of these public policies. There is not enough transmission capacity for all the projects because the total power generation installed capacity is five times higher than expected demand for the next 10 years, according to Abrate director Geraldo Pontelo.

Generators, on the other hand, question the government's decision to deny requests for access — arguing there is not enough capacity on power lines — as it prepares to hold an auction for available transmission capacity. Brazilian legislation ensures that all authorized generation projects have the right to connect to transmission lines, which could mean the new tender would lead to lawsuits.

Public comments from market participants are available [at MME's page](http://antigo.mme.gov.br/web/guest/servicos/consultas-publicas?p_p_id=consultapublicammeportlet_WAR_consultapublicammeportlet&p_p_lifecycle=0&p_p_state=normal&p_p_mode=view&p_p_col_id=column-1&p_p_col_count=1&_consultapublicammeportlet_WAR_cons.