The market for US-crewed and flagged Jones Act vessels has gotten a new boost from demand to ship renewable diesel from the Gulf coast to California, driven by strong state incentives.

The Jones Act requires commercial vessels operating between US ports to be built, owned, operated and manned by US citizens. Jones Act tankers normally command a premium because of their unique status and limited number compared with the overall international fleet.

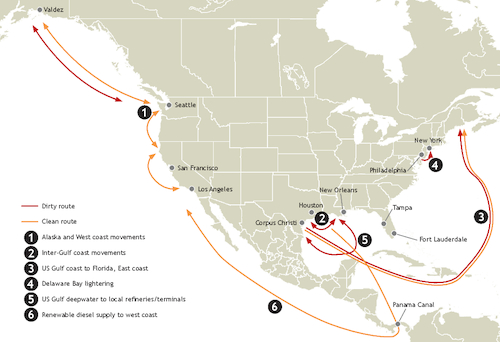

Rising US refined products prices on the heels of Russia's invasion of Ukraine triggered a recovery in rates for Jones Act tankers in 2022, which serve unique regional markets like Florida. The Florida market for gasoline and other refined products is a key driver for clean Jones Act vessels, because the state has no refineries or pipeline connection to the US Gulf coast refining complex.

Now new charterers have entered the market to secure vessels to transport renewable diesel from the US Gulf coast to the west coast, according to Florida-based Jones Act tanker owner Overseas Shipholding Group (OSG).

"We now have a relationship with virtually every major producer of renewable diesel in the Gulf coast," OSG chief executive Samuel Norton said. As many as eight Jones Act tankers will be required to move renewable diesel from refineries on the Gulf coast and through the Panama Canal to California by the end of 2023, which could tie up about 20pc of the total fleet of medium-range Jones Act tankers, Norton said.

Currently, just 48 Jones Act-compliant MR tankers are allowed to transport cargoes between US ports.

A voyage from the Gulf coast to California is four times longer than a normal trip from the Gulf coast to Florida, and "effective vessel supply has tightened considerably with the advent of renewable diesel trades," Norton said.

Kinder Morgan, which operates a fleet of 16 Jones Act tankers, has also pointed to surging demand for moving renewable diesel by vessel.

"We've seen a lot of movement as it relates to renewable diesel from the Gulf coast to the west coast ... which we think will further tighten an already tight Jones Act market," said John Schlosser, president of terminals at Kinder Morgan.

The midstream operator remains on track to begin service at a southern California renewable diesel hub in early 2023, which will connect the company's SFPP fuel pipeline to deliveries from the Los Angeles harbor and rail terminals. The hub will have capacity for up to 20,000 b/d of blended renewable diesel throughput across two truck racks. A third truck rack project would add up to 15,000 b/d of renewable diesel blending capacity.

Strong incentives to use renewable diesel in states like California and Oregon will likely drive demand even higher, Kinder Morgan said.

"Right now, every drop of renewable diesel in the United States wants to go to California," Kinder Morgan president of products pipelines Dax Sanders said.

Fewer lay-ups

A lack of US waterborne shipping demand during the Covid-19 pandemic caused Jones Act ship operators to lay up a third of the ocean-going fleet. That trend has reversed as demand recovered, and OSG swung to profit in the fourth quarter of 2022, which the company attributed to a significant decrease in layup days.

Layup days for OSG's fleet fell by 430 days on the year in the fourth quarter of 2022, as each of its 21 vessels was trading for the entire period. During the fourth quarter in 2021, five of its vessels were laid up — four for the entire period — because of limited demand and depressed freight rates.

The company also attributed its swing to profit to higher daily earnings for its fleet, a 40-day decrease in dry dock days, a two-day decrease in repair days and "strong contributions" from its non-Jones Act and lightering vessels.

All of the company's Jones Act vessels are fixed under time charters or contracts of affreightment for the remainder of 2023, and almost 80pc of available fleet days in 2024 are already fixed as well.

"It is fair to say that the business environment for OSG has shifted away from the defensive posture that has characterized much of the past three years," Norton said.

OSG operates a fleet of 13 Handysize refined product tankers, four crude oil tankers, two refined product articulated tug barges (ATBs) and two lightering ATBs. The company's lone former international-trading Handysize, the Overseas Sun Coast, switched to a US flag in January and now trades in the Jones Act market.

By Chris Baltimore and Michael Connolly