Freight rates for Aframax vessels in the southeast Asia region rose, following an influx of prompt cargoes and chartering activities.

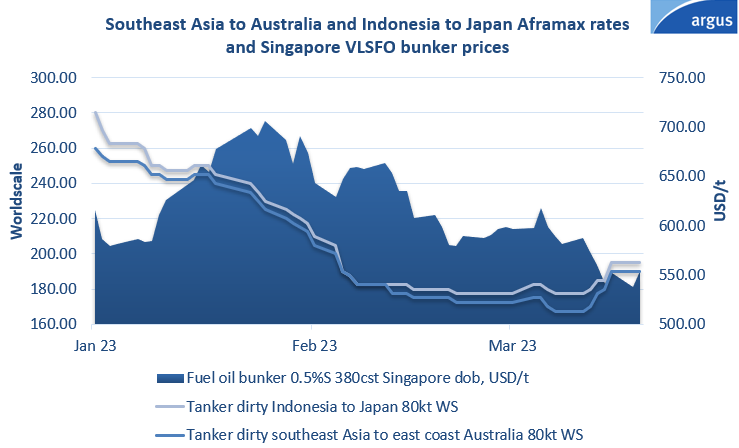

Rates for 80,000t shipments from southeast Asia to east coast Australia and from Indonesia to Japan routes rose by about 13pc and 9.4pc respectively to WS190 and WS195 on 17 March, from WS167.5 and WS177.5 on 9 March, because of a flurry of regional chartering activities. Argus recorded a fivefold week-on-week increase in cargo enquiries on 13 March. The jump in spot cargo volumes was because of charterers holding back on their end-March loading-window requirements, which led to a rush in chartering activity towards the end of last week.

Charterers previously took a backseat as freight rates trended lower towards the end of February when demand was slim, a shipowner said, and because many had also covered their positions up until the mid-March loading window. Competition from clean Long Range 2 (LR2) tankers in the Australian region, owing to a weak clean petroleum product market, caused further tonnage build-up as it encouraged Aframax ballasters to pile up in the southeast Asia region.

Argus time charter equivalent (TCE) rates for non-scrubber fitted Aframaxes on the Australian-bound and northeast Asia-bound voyages rose by about 24pc and 18pc respectively to $58,687/d and $58,764/d over the same period. The TCE spread for Aframaxes in the southeast Asia region subsequently narrowed against earnings in the Mideast Gulf to about $2,294/d on 21 March, compared to about $6,924/d on 9 March.

But the sustainability of this recovery was a concern as the main support for the higher rates have been a consolidated push for vessels from charterers last week, so freight rates could potentially fall if demand proves to be insufficient going forward.

Freight rates could also be pressured, if bunker prices trend lower. The price for very-low sulphur fuel oil with 0.5pc sulphur content in Singapore has fallen by 21pc to $553.83/t, from its peak so far this year at $706/t on 23 January.