The European Commission has defended its gas storage regulations, saying there is no conclusive evidence they caused price spikes in summer 2022, and pointed instead at member states' and operators' high injections.

Changes in supply to Europe, notably from Russia, were more likely to have pushed up prices, according to the commission's report. But "resolute" storage filling by operators, sometimes acting in line with member state regulations, may have "facilitated a temporary overshooting of prices" in summer 2022, according to the commission.

And looking forward, there could be "scope for national measures that implement the EU targets in more efficient ways to avoid filling trajectories that influence price development in a negative manner", the report said. The commission said it was "aware of claims that a more gradual replenishment of storage, including by using the flexibility left by the 2022 intermediary targets set at EU level, could have helped mitigate the price developments".

The gas storage regulation, introduced in June, obliged member states to make sure their storage sites were full to 80pc by 1 November 2022, and to 90pc on 1 November in subsequent years. It imposed intermediary targets for each country, and recommended measures that member states could take to ensure they reached the target.

Gas prices at European hubs rose sharply in February last year after the beginning of the Russia-Ukraine conflict, and again from mid-June, peaking in late August before falling in the fourth quarter of the year (see TTF graph).

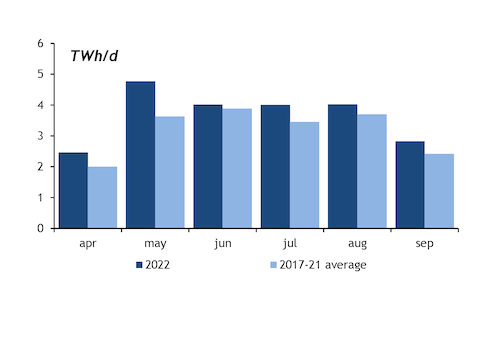

The commission said that storage injections were "in line with" past years in 2022, with the exception of May, October and early November, when they were above the 2017-21 range. The price spikes did not coincide with the periods of highest injections, nor did they come immediately after the implementation of the regulations, and therefore were unlikely to have been caused by these high injections, the commission said.

Instead, a sharp fall in Russian imports in June could explain the price peak, according to the report.

But EU-wide injections held above the five-year average in every month of the summer, according to data aggregator GIE (see injections graph). And total summer injections of 749TWh across the bloc were the highest since 2018.

Injection demand last year was boosted by the German government's purchase of roughly 50TWh of gas through THE, the country's market area manager. Net injections in Germany averaged 861 GWh/d in summer last year, 42pc higher than the five-year average for the season, while EU-wide injections were 14pc higher than the five-year average.

And Germany's gas storage sites were 99pc full on 1 November, well in advance of the commission's 80pc target.