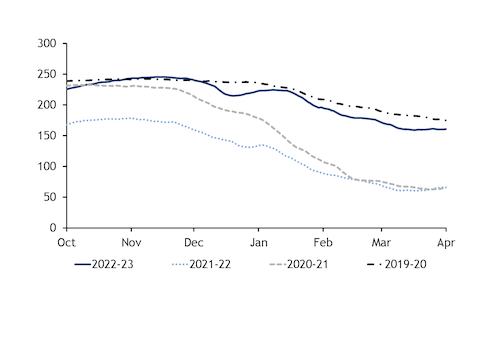

German gas inventories were well above the three-year average on 1 April.

Aggregate stocks were 160.3TWh at the start of the 1 April gas day, equating to 64pc of capacity, up from a three-year average of 101.8TWh, the latest data from the GIE transparency platform show.

A largely mild winter cut into heating demand, while gas prices were sufficiently high to reduce gas use by households, industry and the power sector. And LNG sendout was particularly brisk, reducing the call on storage even as Russian pipeline deliveries to Europe were substantially lower than a year earlier.

Germany has already begun to add supply to its storage sites, with sporadic net injections since 18 March. And there were net injections of 243 GWh/d on 30 March-1 April, lifting stocks to 160.7TWh as of yesterday morning.

But German sites may have since returned to net withdrawals, as overnight lows in Essen moved below seasonal averages. And temperatures were forecast today to hold below average until 17 April, which may limit spare supply to add to storage.

The country must have inventories at 95pc of capacity by the start of November. To reach this would require net injections of 361 GWh/d on 2 April-31 October, well below the three-year average of 537 GWh/d.

Partly because of high stocks, German market area manager Trading Hub Europe (THE) has planned no tenders for strategic storage-based options (SSBOs). And THE has left 37TWh of supply procured for last winter in storage facilities.

THE also cited an existing market incentive to fill storage as a factor in its decision. The THE summer 2023 price expired just over €10/MWh below the winter 2023-24 market on 31 March, suggesting a strong financial incentive to inject.

And the THE second-quarter 2023 price expired €1.18/MWh below the third-quarter 2023 market, suggesting an incentive for firms to front-load the stockbuild.