Traders may be opting to keep LNG cargoes that were previously heading for French terminals as floating storage rather than deliver to Spain, as ample supply and pipeline bottlenecks have weighed on returns from selling into Europe's largest country by LNG import capacity.

Spain's receipt of several diverted cargoes from France has added to its high LNG stocks, increasing the Spanish PVB front-month price's discount to the corresponding Dutch TTF contract and leaving less incentive for deliveries to the Iberian country, which has limited pipeline interconnection to its northerly neighbours.

Spain has the continent's largest LNG import capacity at 44.1mn t/yr. And five vessels carrying as much as 543,730m³ of LNG have diverted away from France to Spain since the start of the country's industrial action on 6 March (see table). The diversions, alongside a fall in consumption stemming from mild weather, left LNG stocks at 2.5mn m³ earlier today — the highest for any date since 17 January — and well above the three-year average of 1.6mn m³.

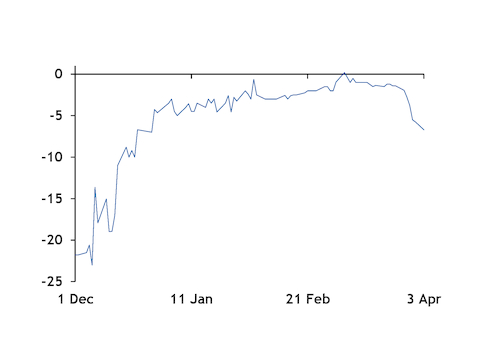

But the PVB front-month price has widened its discount to the TTF as well as the French Peg in recent days. The PVB front-month market closed €6.71/MWh below the TTF on 3 April — the largest discount for any date since 28 December — heavily curbing the incentive to take more deliveries to the country (see price graph).

And with prompt spot charter rates in the Atlantic basin falling in recent weeks, the cost to secure additional shipping capacity to allow firms to keep to loading schedules has fallen substantially.

Several vessels continue to remain offshore northwest Europe, choosing to preserve their cargoes rather than deliver to Spanish facilities. The 165,000m³ Diamond Gas Rose, which had initially declared for the 12.4mn t/yr Dunkirk terminal, then diverted to the 8.7mn t/yr Huelva facility and is today holding offshore, declaring for orders. The 174,000m³ Maran Gas Ulysses which had also previously declared for Huelva, changed its declaration to for orders this morning.

The 180,000m³ Nohshu Maru which diverted away from Dunkirk on 6 March, has now re-declared for Dunkirk for 6 April. And the 174,000m³ Qogir, which had previously declared for Fos-sur-Mer but rerouted to Gibraltar on 23 March, was still offshore the straits of Gibraltar this afternoon, declaring for orders. The 174,000m³ Kool Firn was also holding offshore Gibraltar.

Spain has limited ability to send regasified LNG to northwest Europe because of low capacity at the Pirineos interconnection point, as well as capacity restrictions within the French domestic network.

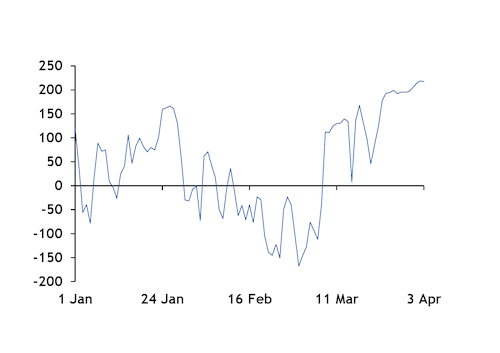

Flows towards France at the Pirineos point have risen in recent days to 219 GWh/d on 2 April — the highest since 30 December 2022 — but remain below peak northward exports of 240 GWh/d (see Pirineos graph). And stronger French withdrawals from underground sites to offset strike action at the country's LNG facilities may have limited the country's capacity ability to absorb stronger imports from Spain because of congestion within the French network.

| LNG vessels diverted from France | m³ of LNG | |||

| Name | Size | Initial terminal | Diversion date | New destination |

| LNG Sokoto | 135,000 | Fos sur Mer | 4-Mar | Isle of Grain, UK |

| Nohshu Maru | 180,000 | Dunkirk | 6-Mar | TBC |

| Minerva Amorgos | 174,000 | Fos sur Mer | 7-Mar | Milford Haven, UK |

| Global Energy | 74,100 | Fos sur Mer | 7-Mar | Barcelona, Spain |

| Maran Gas Olympias | 173,400 | Dunkirk | 8-Mar | Wilhelmshaven, Germany |

| Gaslog Galveston | 174,000 | Dunkirk | 12-Mar | Zeebrugge, Belgium |

| Nikolay Zubov | 172,600 | Montoir | 14-Mar | Zeebrugge, Belgium |

| Golar Crystal | 160,000 | Fos sur Mer | 14-Mar | Barcelona, Spain |

| Seapeak Bahrain | 173,000 | Montoir | 16-Mar | Isle of Grain, UK |

| Diamond Gas Rose | 165,000 | Dunkirk | 16-Mar | TBC |

| Gui Ying | 174,000 | Montoir | 16-Mar | Milford Haven, UK |

| BW Tulip | 173,400 | Montoir | 17-Mar | Lubmin, Germany |

| Sonangol Sambizanga | 160,000 | Montoir | 18-Mar | Barcelona, Spain |

| LNG Bonny II | 177,000 | Fos sur Mer | 20-Mar | Revithoussa, Greece |

| Cool Voyager | 160,000 | Montoir | 21-Mar | Dunkirk, France |

| La Seine | 174,000 | Fos sur Mer | 21-Mar | Marmara, Turkey |

| Cheikh Bouamama | 75,500 | Fos sur Mer | 23-Mar | Revithoussa, Greece |

| Qogir | 174,000 | Fos sur Mer | 24-Mar | Gibraltar, UK |

| Energy Spirit | 74,130 | Fos sur Mer | 30-Mar | Huelva, Spain |

| Cheikh el Mokrani | 75,500 | Fos sur Mer | 1-Apr | Cartagena, Spain |

| Al Ghashamiya | 217,600 | Fos sur Mer | Holding offshore Fos | |

| Minerva Limnos | 173,400 | Montoir | Set to deliver on 5/4 | |

| Fleetmon, Vortexa | ||||