EU manufacturing output rose year on year in the first quarter, according to preliminary data from Eurostat.

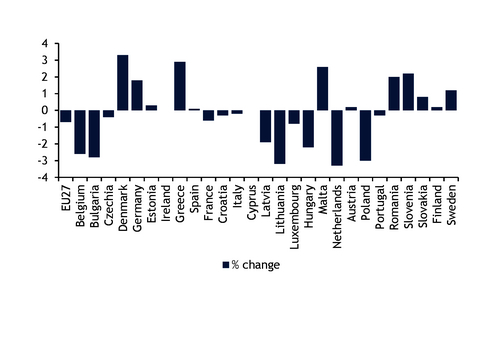

First-quarter production was 1.5pc higher than a year earlier, although this was the smallest year-on-year increase since the fourth quarter of 2020. Activity was mixed across the bloc's top five gas-consuming countries, with output rising in Germany, Spain and France, but down in the Netherlands and Italy (see year-on-year graph).

There was significant variation across the quarter, with growth in January and February partly offset by weaker output in March.

While EU manufacturing output was higher on the whole, production from most key gas-intensive sectors was much lower, with chemicals and non-metallic minerals falling the most at 14.6pc and 9.2pc respectively (see year-on-year sector table).

Output from the German chemicals sector, by far the largest in the EU, dropped by 14.8pc on the year, and a vigorous recovery in the sector is still out of sight according to industry association VCI. The production of ammonia in Europe remains uncompetitive with imports from abroad, which has led to sustained curtailments in production.

Similarly, the output of glass — a key part of the non-metallic minerals segment — fell steeply in the first quarter. Gas and power costs account for around 24pc of total output costs, according to the European container glass federation.

Unlike several other gas-intensive industries, the manufacture of motor vehicles continued to recover, rising by 16.9pc on the year as chip shortages eased.

Production down on the quarter

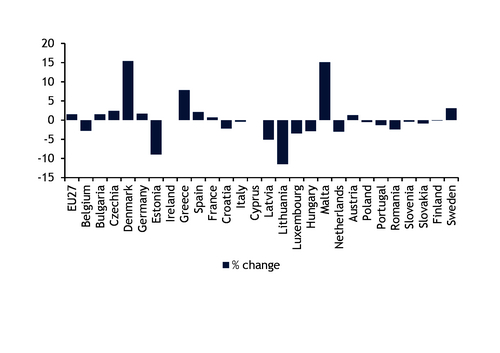

EU manufacturing output was 0.7pc lower in January-March than in October-December, even as gas prices fell drastically.

Manufacturing output grew in Germany and Spain from the previous quarter, but was more than offset by falls in Italy, France and the Netherlands as well as many other countries in the bloc (see quarter-on-quarter graph).

Gas-intensive industry drove the drop, led by the paper and paper products and the non-metallic minerals sectors (see quarter-on-quarter sector table). Output from the biggest gas-consuming industry, the chemical sector, was marginally down year on year.

Manufacturing production weakened even as gas prices fell in the first quarter from the fourth quarter. Besides rising commodity prices, wider economic pressures such as inflation and supply-chain issues, and decisions to relocate production outside of Europe have contributed to weak manufacturing production across the region.

| EU y-o-y sector change | ±% |

| All manufacturing | 1.5 |

| Chemicals and chemical products | -14.6 |

| Non-metallic minerals | -9.2 |

| Food, beverage and tobacco products | 0.6 |

| Paper and paper products | -10.3 |

| Basic pharmaceuticals | 19.9 |

| Basic metals | -6.4 |

| Coke and refined petroleum products | -2.2 |

| Motor vehicles and other transport | 16.9 |

| — Eurostat data calendar adjusted but not seasonally | |

| EU q-o-q sector change | ±% |

| All manufacturing | -0.7 |

| Chemicals and chemical products | -0.1 |

| Non-metallic minerals | -3.1 |

| Food, beverage and tobacco products | 1.2 |

| Paper and paper products | -3.3 |

| Basic metals | 0.8 |

| Basic pharmaceuticals | -6.7 |

| Coke and refined petroleum products | -0.3 |

| Motor vehicles and other transport | 2.7 |

| — Eurostat data seasonally and calendar adjusted | |