Vessels traveling in EU territorial waters without scrubbers next year may start using more biofuels when regulations require them to start paying for their CO2 emissions.

Ships operating in the EU territorial waters will have to pay for 40pc of their CO2-equivalent emissions starting in 2024, 70pc from 2025, and 100pc from 2026. Since 2015, the North Sea and the Baltic Sea have been designated as emission control areas (ECA), where marine fuel sulphur content has been capped at 0.1pc. Ships currently operating in the ECA burn 0.1pc sulphur marine gasoil (MGO) or utilise marine exhaust scrubbers and burn high-sulphur fuel oil (HSFO).

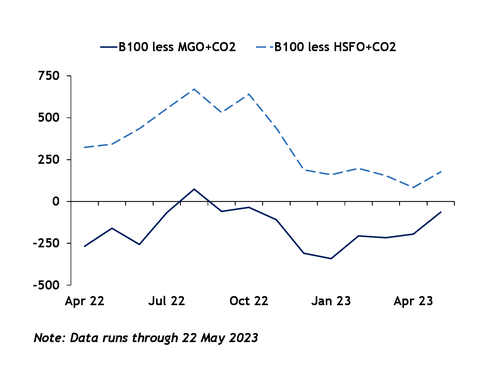

In 2024, vessels traveling in the northwest Europe ECA with no scrubbers could switch from burning MGO to B100 biofuel. The added CO2 emissions cost could drive the price of MGO at a premium to B100. By contrast, vessels traveling in the northwest Europe ECA with installed scrubbers could continue to burn HSFO in 2024. From April 2022 to 22 May 2023, even with the added cost of CO2 emissions, HSFO was pegged at a discount to B100, Argus data showed (see chart).

Between the fourth quarter of 2021 and the first quarter of 2023, biofuels bunker blends, MGO and HSFO accounted for 5-9pc, 11-20pc and 28-33pc, respectively, of Rotterdam's bunker demand. Provided that the HSFO price with added CO2 cost remains below B100 in 2024, the share of HSFO Rotterdam demand could remain steady or even increase if more scrubber-outfitted vessels enter the market. By contrast, if MGO with added CO2 cost is priced at a premium to B100, the share of biofuel bunker sales in Rotterdam could rise above 9pc.

Biofuel for bunkering appetite in Rotterdam also depends on the Netherlands renewable fuel subsidies. The amount of subsidies is revisited by the Dutch government yearly. Subsidies shaved 38-66pc from the outright price of biodiesel sold for bunkering in Rotterdam from Jan 2022 to 22 May 2023, Argus assessments showed.