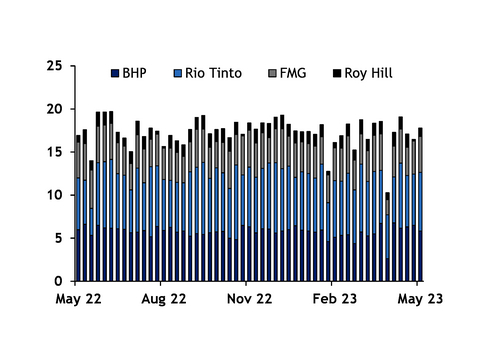

Western Australian (WA) iron ore shipments returned to above average in the week to 20 May, despite the tail end of Roy Hill's quarterly maintenance programme.

WA iron ore shipments were above average as BHP and Fortescue raised throughput ahead of the end of their fiscal year on 30 June.

The four big Pilbara iron ore firms — Rio Tinto, BHP, Fortescue and Roy Hill — loaded vessels with a combined 17.78mn dead weight tonnes (dwt) of capacity in the latest week, up from 16.48mn in the week to 13 May, according to initial shipping data collated by Argus. The dwt is the maximum capacity of a vessel and overestimates actual shipments by around 5pc.

Total shipments were 3pc above average, with BHP and Rio Tinto close to average and Fortescue rising to 11pc above average, offsetting lower throughput by Roy Hill.

Shipments from BHP slipped to 5.83mn dwt in the week to 20 May, below 6mn dwt/week for the first time in four weeks, although 1pc above average. Shipments could slide below average over the following weeks because of structural remediation work on BHP's Finucane Island C and D berths.

BHP needs to export 68.5mn-80.5mn t of iron ore in April-June, up from 66.58mn t during January-March to meet its target of 278mn-290mn t on a 100pc basis for the July 2022-June 2023 fiscal year. Initial shipping data to 22 May shows that BHP shipped similar volumes of ore in the first 52 days of April-June as it did in the first 52 days of January-March, implying it is likely to try to ramp up shipments over the remainder of this quarter. June is often one of BHP's strongest iron ore shipping months.

Fortescue must ship 43.6mn t in April-June, below the 46.3mn t shipped in January-March, to meet the bottom of its target of 187mn-192mn t for the year to 30 June. Its shipments are also in line with the first half of January-March, but the company does not need to ramp up from there to meet the middle of its target. Fortescue shipped 4.15mn dwt in the week to 20 May, up from 3.86mn dwt in the prior week.

Roy Hill shipments rebounded to 985,000dwt from 179,000dwt the previous week, which were 21pc below average as it carried out its quarterly maintenance shutdown. The company dispatched a ship on 17 May, the first since 7 May.

Rio Tinto loaded vessels with capacity of 6.82mn dwt in the week to 20 May, up from 5.95mn dwt the prior week and 4pc above its average of 6.58mn dwt/week over the past year.

China was listed as the destination for 84pc of shipments in the latest week, up from 80pc in the previous week and above the average of around 82pc.

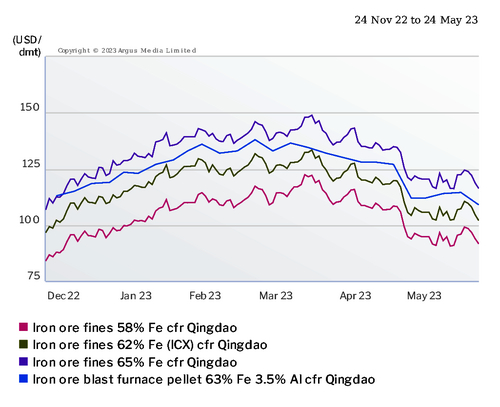

TheArgus ICX iron ore index was last assessed at $102/dry metric tonne (dmt) cfr Qingdao on a 62pc Fe basis on 23 May, down from a high of $133.40/dmt on 15 March but up from a low of $79/dmt on 31 October 2022.