More firms are building ethane cracking into their operations in a bid to move away from LNG, write Rituparna Ghosh, Matthew Rajendra and Pranav Joshi

India's ethane imports from the US are on course to increase significantly in the coming years as new ethane-fed ethylene projects open and existing plants switch from natural gas liquids (NGL) stripped from Mideast Gulf LNG to the US' supply.

State-controlled refiners Bharat Petroleum (BPCL) and Gail are investing in new ethane-fed cracker projects at their existing petrochemical facilities to capitalise on the abundant availability of cheap US ethane and the growing fleet of very large ethane carriers (VLECs). This follows on from private-sector refiner Reliance switching to US ethane at its 1.5mn t/yr ethylene cracker in Jamnagar, in west India's Gujarat state, over the past few years, having previously relied on ethane extracted from LNG imports from the Mideast Gulf.

Gail operates two 450,000 t/yr crackers at its Pata petrochemical plant in Uttar Pradesh in northern India, which can use either ethane or propane. This arrives through the Hazira-Vijaypur-Jagdishpur pipeline having been fractionated and processed from LNG at Hazira on the west coast of Gujarat. BPCL is also increasingly integrating its refining operations with petrochemicals, but presently only has 500,000 t/yr of propylene capacity at its 310,000 b/d Kochi refinery in Kerala.

BPCL is investing close to $6bn to develop an ethane-fed cracker at its 156,000 b/d Bina refinery in Madhya Pradesh, while Gail is spending a similar amount on building a 1.2mn t/yr ethane-fed cracker near its 5mn t/yr LNG plant at Dabhol in Maharashtra. Gail has signed an initial agreement with Shell Energy India to import US ethane and has expressed interest in hiring VLECs to transport the supply over 20 years starting from mid-2026.

The plans are partly aimed at cutting reliance on LNG after a shortage last year prompted by disruptions to supplies from Russia's state-controlled Gazprom in the wake of the war in Ukraine, and surging international prices. Petrochemical producers in India imported 1.3bn m³ of LNG in 2022, down by 47pc on the year, oil ministry data show. This resulted in Gail shutting down its Pata plant for a few months and then operating it at a lower utilisation when it was brought back on line. Besides the price and reliability of LNG imports, the act of processing and fractionating it for use in NGLs in India also adds complication and costs.

"We continue to focus on differentiated and specialty polyester products," Reliance said recently. "We have always mentioned about having zero dependence on LNG and that essentially continues."

Plant pressures

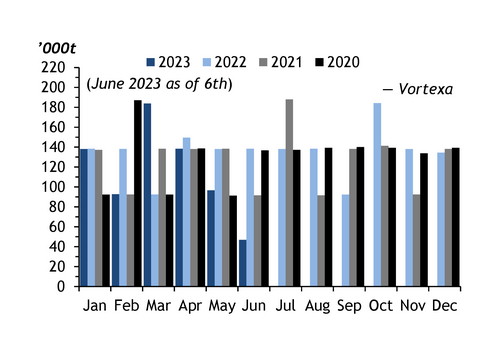

India's ethane imports have been relatively steady in recent years. They reached 1.62mn t in 2022, compared with 1.53mn t in 2021 and 1.57mn t in 2020, Vortexa data show. But the country's expanding ethylene production capacity and domestic consumption will boost this in the coming years. India's ethylene demand is likely to increase to 8.7mn t and polyethylene consumption to 6.9mn t by 2026, Argus calculates.

Yet the outlook for the polymers market this year remains bleak, with a number of Indian polyethylene producers facing inventory pressures at their plants. Low polymer prices have made it difficult for producers to reduce prices further in this current bearish environment to clear excess inventories. Margins have also been squeezed, with Reliance's polymer margins declining by 9pc during its 2022-23 financial year. Linear low-density polyethylene import prices had fallen by 43pc on the year to $950-980/t by 1 June. This has negatively affected buying ideas in India's domestic markets. Stronger spreads from ethane cracking could give Indian producers more scope to cut polyethylene prices to stimulate demand if needed in the future. But oversupply of olefins and polymers continues to be a global challenge.