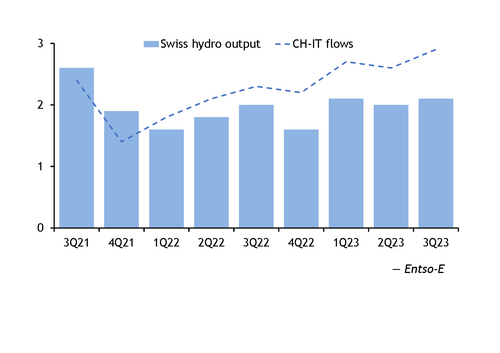

Higher Swiss hydropower generation and an uptick in Italian demand so far this quarter has pushed Swiss exports to Italy to the second-highest over the past five years, although exports may decline over the rest of the quarter on falling Swiss generation and higher French nuclear availability.

Switzerland's hydropower output has averaged 2.1GW so far in the third quarter, the highest since the third quarter of 2021. And increased solar output has outweighed lower-than-average nuclear generation for the third quarter following unplanned outages at both 365MW Beznau nuclear units in July to push total generation up to the highest since the first quarter of 2021 at 5.2GW.

Increased output has pushed Switzerland to a net exporter this quarter, with exports to Italy in particular stepping up as demand has risen on higher temperatures.

Maximum temperatures in Rome on 1 July-6 August averaged 31.7°C, up from 27.8°C across June and 1.3°C above seasonal norms. Higher temperatures have supported cooling demand in Italy, increasing power demand by 4.9GW on the quarter to the highest since at least 2018 at 35.7GW. Power demand in Italy reached a peak on 19 July at 44.6GW, the highest for any day this year.

But a more than 4GW increase in domestic Italian gas-fired output on the quarter has not kept pace with demand, pushing Swiss exports to Italy to an average of 2.9GW so far this quarter, the second-highest over the past five years.

Cross-border capacity costs from Switzerland to Italy for July were lower this year compared with 2022 as allocated capacity more than tripled. Some 852MW in the Switzerland-Italy direction cleared at €17.32/MWh, rising from just 237MW at €27.08/MWh for July last year. The auction placed Italy's implied premium at €17.14/MWh, €11.04/MWh lower than the average Italian north-zone premium to its Swiss counterpart in the day-ahead market.

The time difference between the auction and the actual delivery period can lead to a disparity between CBC costs and day-ahead price deliveries, with day-ahead prices also being driven by fundamental factors that were unexpected at the time of the auctions.

CBC capacity from Switzerland to Italy for August delivery was also lower on the year, clearing at €17.44/MWh compared with €32.55/MWh in 2022. Italy's implied premium cleared at €17.37/MWh, just €2.63/MWh below the August Italy-Switzerland premium at expiry in the over-the-counter market.

August, September outlook

But August typically sees Switzerland's net export position beginning to tighten as hydropower output declines. Swiss hydropower stocks moved to a deficit to the long-term average for the first time this year in week 30, and current forecasts for Sion in the hydro-rich canton Valais suggest rainfall will average just 1mm/d next week compared with seasonal norms above 1.4mm/d, which may limit inflows further.

And the 365MW Beznau 2 reactor went off line for maintenance on 4 August and will remain unavailable until mid-September, which will also weigh on Swiss output as solar generation declines towards the end of summer, probably curtailing exports to Italy towards the end of the quarter. Sion is also due to see maximum temperatures generally at least 3.4°C above long-term averages through to mid-September, which may weigh on demand and restrict exports further.

Italian hydropower stocks have also begun to decline in the past two weeks as the contribution of snowmelt to inflows is reduced. Hydro reservoirs in Italy in week 30 fell by 0.8pc to the lowest in three weeks at 3.73TWh, and forecasts indicate that precipitation across northern Italy will fall well below seasonal norms next week, with rainfall in Malpensa on 7-13 August forecast at 2.2 mm/d below the norm.

But the onset of the summer holiday may soften power demand in Italy, reducing the need for imports. European grid operators association Entso-E has forecast maximum aggregate load this week at 36.9GW, down from 42.2GW last week but above 36.8GW in the equivalent week last year.

In the front month, Switzerland's discount to Italy has been assessed by Argus at €11.60-13.90/MWh so far in August, compared with an average discount of €19.74/MWh for August delivery across last month. By contrast, Italy's front-month premium to France was assessed at €19.60-23.05/MWh on 1-4 August, suggesting that France may displace Switzerland as Italy's main power exporter.

And French nuclear unavailability is due to step down in September, averaging just 14GW across the month compared with 22.2GW throughout August and 26.6GW in July, which may lift exports to both Switzerland and Italy.