Venezuelan petroleum coke exporters have lowered shipments to China and halted supplies to India recently, but they restarted sales to Turkey and Brazil as a shift in contract pricing adjusts arbitrages.

Turkey, historically one of Venezuela's key consumers, could once again become a stable buyer of the country's coke going forward after taking none between December 2022 and July of this year, market participants said.

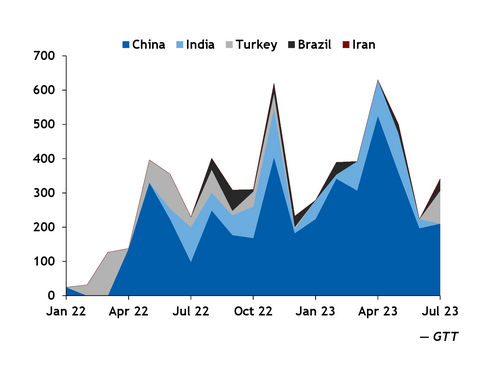

Global imports of Venezuelan coke rose to 341,700t in July from 223,700t in June and 229,600t in July 2022, according to customs data from partner countries compiled by Global Trade Tracker (GTT). Venezuela does not report export data.

But although overall global receipts of Venezuelan coke rose, Indian imports of Venezuelan coke fell to zero in July for the first time since May 2022, according to GTT. This was despite a 16pc overall increase in Indian coke imports from June.

Shipments to China, which has been the largest buyer of Venezuelan coke over the past year, have also declined recently. China imported 210,200t in July and 196,600t in June, maintaining its spot as the largest buyer. But this is down from an average of 351,100t/month in January-May. Loadings to China from Venezuela were heard to have halted over the last two months, with no ships loaded for China in July or August and none scheduled to load in September or October.

Meanwhile, Turkey imported coke from Venezuela in July for the first time this year. Brazil also received about 30,900t of coke in July — the third cargo this year after 27,100t in May and 35,700t in February. Venezuela was set to ship two more vessels to Brazilian cement plants in August, one trader said.

In addition, about 4,000t of coke were delivered to Iran in July, the first Venezuelan shipment to the country, GTT data show.

Marketing changes cause destination shifts

While the reasons for the change in export destinations are not entirely clear, it appears to be related to an adjustment in Venezuela's coke export contracts this year.

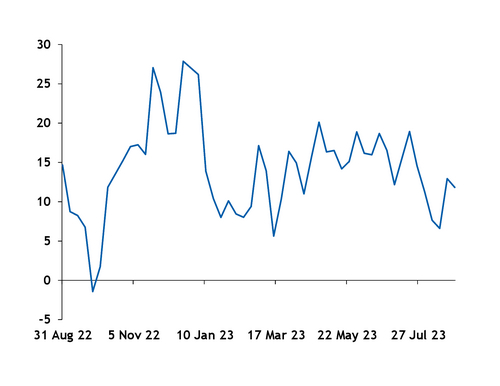

Some traders who had previously sold to India had supply relationships with Maroil Trading, a Geneva, Switzerland, firm that had a contract to market Venezuelan coke. This agreement allowed them to offer the supply at around a $10/t discount to the cfr India US Gulf-origin 6.5pc sulphur price, a necessary concession to Indian buyers to accommodate more challenging payment terms and risks of loading delays. But since earlier this year, a change in Maroil's contract with state-owned oil company PdV has adjusted fob prices to be based on the US Gulf 4.5pc sulphur index, which trades at a premium to the fob US Gulf 6.5pc sulphur price. The delivered India 4.5pc sulphur price — based on US Gulf fob prices plus freight from the US Gulf to India — has traded at an average premium of $13.70/t over the cfr India 6.5pc sulphur price so far this year. And freight from Venezuela to India is higher, increasing costs for sellers. Freight rates reached around $47/t for the Venezuela-to-India route in late August, which leaves little scope to sell below $140/t cfr India, considering the last Argus US Gulf 4.5pc sulphur assessment was $107.50/t, according to a market participant.

These higher fob costs have caused Venezuelan coke to lose market share in India. And shipments to China may have dropped because of high inventories at ports, including older cargoes from Venezuela that could not find local buyers. China received about 2.16mn t from Venezuela in the first seven months of 2023, exceeding the full-year 2022 total of almost 2mn t.

Lower freight costs from Venezuela to Brazil might be the reason for increasing shipments along this route. Freight from Venezuela to Brazil is around $20/t compared with freight from the US Gulf to Brazil of around $35/t, according to a market participant. Venezuelan coke was being offered at $165/t cif Brazil recently, which would net back to well above recent US Gulf 4.5pc sulphur fob prices.

The most recent offers of Venezuelan coke to Turkey, on the other hand, were at $85/t fob for September loading, meaning a $13/t and $22.50/t discount to the US Gulf 6.5pc and 4.5pc sulphur coke assessments, respectively. But this coke was offered through new trading firms that may have different cost structures. Turkey's state oil company Turkish Petroleum International (TPIC) and PdV have a long relationship and the Turkish government could be unofficially supporting Venezuelan coke imports as part of a broader agreement with the Venezuelan government.