Manufacturing production across the EU fell by more than 6pc on the year in September, the largest drop for any month since June 2020, preliminary data from Eurostat show.

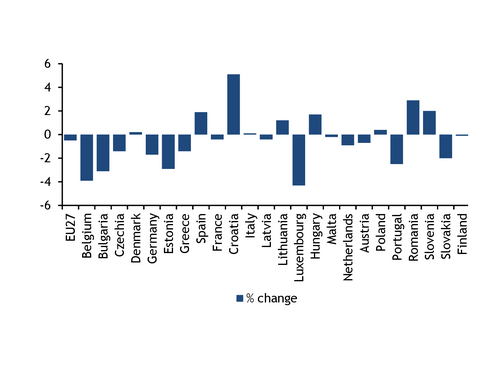

EU output fell by 6.1pc from September 2022, its fifth consecutive year-on-year reduction. It was lower than a year earlier in four out of the five top gas-consuming countries — Germany, the Netherlands, Spain, Italy and France (see year-on-year graph). Only Spain, one of Europe's most resilient economies over the past two years, managed a small increase of 0.6pc on the year. September was the weakest month of German output compared with a 2015 basis since March last year.

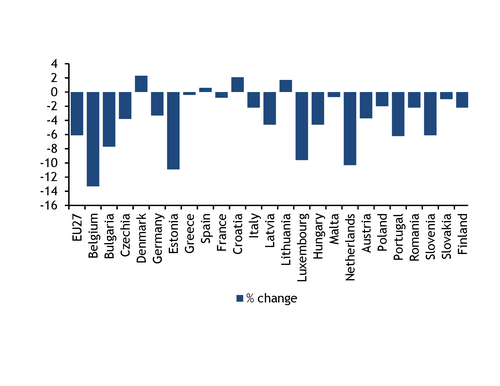

Dutch manufacturing output has fallen on the year in every month so far in 2023, but the 10.3pc decline in September was the steepest since April's 12pc. The country's gas-intensive chemicals and refining sectors have consistently struggled this year.

Manufacturing output in almost all EU countries was lower on the year, with output only growing in Spain, Lithuania, Croatia, Sweden and Denmark. The latter two economies have been similarly resilient to Spain — Swedish production has grown on the year in seven out of the last nine months, while Danish output last fell on the year in December 2020.

Output in almost all key gas-intensive sectors was much lower than a year earlier in September. The non-metallic minerals and paper products sectors led the decline for the fourth month in a row, falling by 11.4pc and 10.3pc, respectively (see year-on-year sector table). Motor vehicle manufacturing was up by 3.5pc, the smallest increase for any month since April 2022. The coke and refined petroleum products sector registered a second consecutive year-on-year increase, having declined in every month in January-July.

Output lower on the month

EU manufacturing also ticked down by 0.5pc from August, reversing a recent trend — output rose on the month in four of the past five months, including in August.

Manufacturing output increased on the month in Spain and Italy, but fell in France, Germany and the Netherlands (see month-on-month graph).

Output in almost all gas-intensive sectors fell in September from August, with the exception of chemicals and coke and refined products (see month-on-month sector table). Chemicals, the most gas-intensive industry, registered a 1.3pc increase, a second consecutive month-on-month increase and the third in the past five months. But against a 2015 baseline of 100, EU chemicals output was still only 90.9 in September, the highest since November last year but still well below pre-2022 averages.

EU economy loses momentum

The EU economy has lost momentum and the future trajectory of energy prices remains a concern, the European Commission said today in its Autumn Economic Forecast.

The commission revised down its forecasts for gross domestic product (GDP) growth in the EU and in the eurozone this year, by 0.2 percentage points to 0.6pc. It said inflation, while declining, and the monetary policy put in place to control it, "took a heavier toll than previously expected" this year, and noted that indicators for October point to subdued economic activity in the fourth quarter.

It sees GDP growth in 2024 at 1.3pc for the EU, underpinned by continued easing of inflation rates. But it said the damage caused by elevated energy prices — following the drop in Russian gas supplies — has dented cost-competitiveness and called for "an ambitious policy agenda" to close a gap with other regions.

The highest expected growth rates are concentrated in central and eastern Europe, with many of Europe's larger economies expected to grow much more slowly.

| EU month-on-month sector change | ±% |

| All manufacturing | -0.5 |

| Chemicals and chemical products | 1.3 |

| Non-metallic minerals | -0.5 |

| Food products and beverages | -0.3 |

| Paper and paper products | -0.3 |

| Basic metals | -0.4 |

| Coke and refined petroleum products | 1.9 |

| Motor vehicles and other transport | -1.9 |

| — Eurostat data seasonally and calendar-adjusted | |

| EU year-on-year sector change | ±% |

| All manufacturing | -6.1 |

| Chemicals and chemical products | -3.7 |

| Non-metallic minerals | -11.4 |

| Food products and beverages | -2.0 |

| Paper and paper products | -10.3 |

| Basic metals | -3.9 |

| Coke and refined petroleum products | 3.7 |

| Motor vehicles and other transport | 3.5 |

| — Eurostat data calendar-adjusted but not seasonally | |