Petroleum coke shippers have increasingly looked to Panamax and other larger vessels in recent weeks as Supramax vessel availability has tightened, driving rates to 18-month highs.

Loading cargoes into larger vessels has allowed coke shippers to move end-of-year inventory while taking advantage of comparatively lower freight rates, as Supramax vessels — a more typical size for the market — have become difficult to secure because of delays in transiting the Panama Canal.

Panamax vessels currently offer a $7-$10/t freight rate advantage over Supramax vessels on voyages from the Mississippi River to India, while a baby Cape freight rate could be more than $10/t lower, a shipbroker said. This gives shippers more room to potentially turn a profit, as they can offer larger cargoes at slight discounts to Supramax cargoes on a cfr basis.

Last week, a buyer received an offer for a part-cargo from a Panamax vessel at $125/t cfr east coast India, while a 100,000t baby Cape cargo of high-sulphur coke was sold in the mid-$120s/t cfr west coast India with a loading option from December-February, undercutting cross-month December- and January-loading 50,000t deals in the high-$120s/t cfr. Capesize rates had been significantly cheaper than Supramax a few weeks ago, before shooting up to 17-month highs in late November.

Supramax vessels are also harder to come by at the moment, with many ships taking longer voyages through the Suez Canal or around the southern coasts of Africa or South America to avoid congestion at the Panama Canal, which is "effectively shut for most bulk carriers in the current bidding system," another shipbroker said. Wait times at the Panama Canal could potentially stretch for months.

Shippers also may have been preferring larger vessels in recent weeks in a push to clear inventory, as sellers typically aim to have low inventories at the end of the year for accounting purposes.

But larger vessels will remain relatively uncommon for coke transport because not all loading and unloading ports can accept these classes because of draft restrictions, with this trade being mostly seen out of the Mississippi River or US east coast ports. And while some large Indian cement makers can receive these vessels, but not all buyers can accept them.

Coke shippers are also dealing with an outage at United Bulk Terminals, a major Louisiana dry bulk facility. And recent attacks on commercial vessels in the southern Red Sea have also made some shipowners warier of the Suez Canal route.

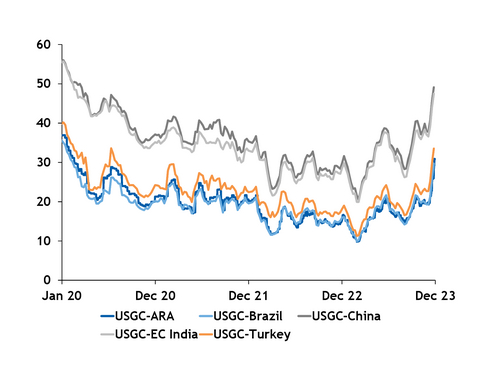

The weight of freight, or the cost of freight compared with the total delivered cost of coke in a given market, recently reached the highest levels since early 2020 in most fuel-grade coke markets. This could be even more significant in the anode-grade market, where shipping costs are already higher because cargoes are typically smaller sized. One anode-grade coke cargo was heard to have its freight costs jump from the mid-to-high $80s/t to the mid-$110s/t in the past week.