The Italian single national wholesale power price (Pun) fell significantly on the month and the year in November, owing largely to higher renewables generation and falling carbon allowance prices.

The Italian spot price averaged €121.74/MWh in November, down by 9.3pc from October and 46pc from November 2022.

The Pun price moved in the opposite direction to French and German spot prices, which remained well below the Italian equivalent despite recording month-on-month increases of 5.1pc and 4.2pc, respectively, to average €89/MWh and €91.10/MWh. This was a result of relatively low temperatures in France and Germany ahead of winter, with minimum temperatures in Paris and Essen averaging 5.7°C and 4.9°C, respectively, compared with 11.1°C in Rome.

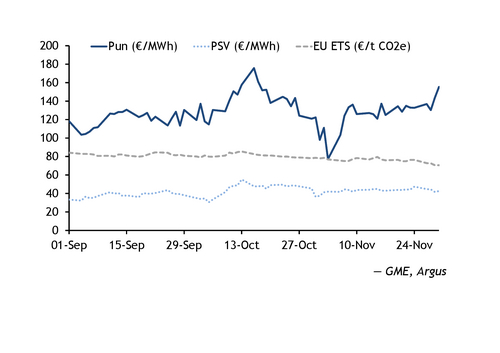

Italian wholesale prices were little affected by movements in the PSV gas market, while falling EU carbon allowance prices had more of an impact. The PSV day-ahead contract was assessed by Argus at an average of €43.32/MWh in November, down by just 1.7pc on the month, against a 0.1pc fall on the equivalent Dutch TTF product. But prompt EU emissions trading system (ETS) allowances fell by 6.3pc to €75.82/t CO2e, weighing on emissions costs for Italian gas and coal-fired plants (see chart).

Output from renewables sources in November — including self-consumption — rose by 15pc on the month to the highest since August at 15.9GW, covering around 45pc of power demand, against 39pc in October. Italian power demand inched up by 600MW to 31.6GW, above 31.3GW in November last year.

Hydro output rose by 1.3GW to the highest since June at 5.9GW, while wind generation increased by 1.6GW to the highest since at least May 2018 at 4.1GW. Higher hydro and wind power more than offset a decline in solar photovoltaic output, which fell by 834MW to 1.6GW — the lowest since January.

And coal-fired generation also rose, inching up by 186MW on the month to 805MW, but remained well below 2.3GW in November 2022.

Coal in November 2022 was well ahead of gas in the merit order, with day-ahead clean dark spreads for 40pc efficiency averaging a €1.57/MWh advantage to clean spark spreads for 55pc efficiency in November, flipping from a €5.14/MWh average disadvantage in October. Day-ahead cif ARA coal swaps in November fell by 12pc on the month to €16.18/MWh.

Increased generation from sources with relatively low or zero variable costs displaced gas from the Italian power mix, pushing gas-fired generation down by 2.3GW to the lowest since May at 9.6GW.

Gas-fired generation has been strong in December, as a cold snap has driven up power demand for heating and renewables output has dropped. Gas-fired output has averaged 12.6GW over 1-12 December, the highest since July but well below 16.8GW in December last year. And front-month spark spreads for 55pc-efficient gas-fired plants on 30 November were assessed at a €3.62/MWh advantage to dark spreads for 40pc efficiency, suggesting improved fuel-switching economics.