The UK government on 18 January announced that it is considering four options under which it will fund a support mechanism for large-scale biomass-fired generators' move to bioenergy with carbon capture and storage (Beccs) during the so-called "bridging" gap, between the end of existing support and the start-up of Beccs units from 2030.

The government announced the four options — and two additional ones that it said did not meet success factors — in a consultation launched on 18 January as to whether it should provide this transitional support for large-scale power Beccs projects and, if so, the best route for achieving it.

Most of the options are based around a consumer-funded contracts for difference (CfD) mechanism, in which the government has significant experience, it said. These include:

- A CfD similar to existing support, in which the generator has flexibility on the volumes of power generated

- A CfD generation collar — with a minimum-maximum range on volumes generated

- Availability payment

- Regulated margin (see table)

While the first option is straightforward and familiar to generators, it could incentivise strong biomass burn. Additionally, expected high fuel costs may imply higher costs to consumers, the government said, adding that there is a "risk that in a time of acute high prices, generators will find routes to market for their biomass fuel and do not generate or generate lower volumes". This would risk "denying the consumer the price support they were expecting in high price periods", while they continue to pay for the support in low-price periods, the government said.

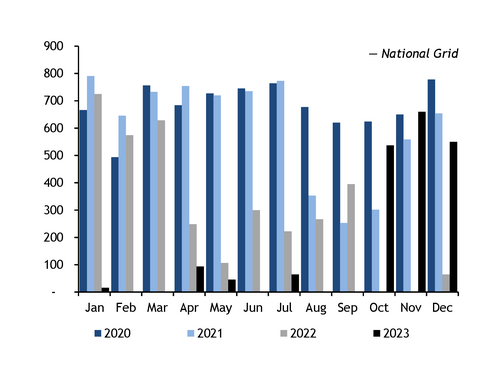

CfD generation at biomass-fired plants was near zero in the 12 months to September last year, as volatility in forward and spot power prices in the two seasons from April 2022 rendered the scheme unprofitable for utilities. Considerations laid out in the consultation seem to suggest the government is less keen to repeat such a scenario in its future support of these utilities.

The government favours the second option, of CfDs with a collar on output. While it's a moderately more complex model than the first option, it would lead to a lower load factor and therefore lower overall costs to the consumer. This option is expected to encourage generation to be more concentrated at times of higher market prices. Hence, there is "a lower risk of crowding out intermittent renewable generation … and has the added benefit of a lower probability that utilities would be able to take advantage of volatile price scenarios, leading to better value for money", the government said.

The availability payment option would support utilities in remaining operational and generating when market signals dictate a positive bark spread and receive no support for any generation. This is potentially the lowest-cost option, but it could lead to a higher-carbon outcome provided that biomass could be "reasonably expected to come after gas" in the UK's power merit order, which would lead to higher gas-fired output, the government said.

For the regulated margin option, two sub-options were presented:

- A CfD contract with the strike price based on a market benchmarked source of fuel costs, plus a spread to cover operating costs and "reasonable generator margin"

- A CfD contract regulated through a cap on excess profit, essentially an open-book agreement

This "more interventionist" option would require a more complex design, would take longer to develop and is harder to implement within the constrained timetable, the government said.

Its two non-preferred options were mothballing and the early deployment of CfD support for power generation under the Beccs support contract, with the strike price based on the cost of running an unabated plant.