A potential re-imposition of US sanctions on Venezuelan oil is unlikely to have much impact on US Gulf coast petroleum coke quality, as the loosening of sanctions since late 2022 has failed to result in significant changes to mid-sulphur coke availability.

Uncertainty has arisen in recent weeks about whether the US will restore sanctions on Venezuelan state-owned oil company PdV, which has affected demand for the country's petroleum coke. But this would not necessarily affect Chevron's ability to import Venezuelan crude into the US, which the US Treasury Department has allowed since late 2022, separate from its decision to temporarily lift the sanctions against Venezuelan oil products in general in October 2023.

The easing of sanctions has seen the crude more regularly supply US Gulf coking refineries over the past year, but the overall impact on coke quality has not been notable, suggesting that even a substantial shift in US policy against the Latin American country would not significantly change US mid-sulphur coke availability.

The sulphur content of Venezuelan sour crude does not concentrate in coke as much as many other crude grades, which has allowed some refineries to experience occasional changes in their coke's sulphur content from processing Venezuelan crude. Sanctions were seen as a major impediment to mid-sulphur coke availability when they were first issued in 2019.

Although one or two US refineries have been able to increase sales of some higher-quality petroleum coke as a result of imports of Venezuelan crude in the past year, most have not used it as a significant proportion of their feedstock.

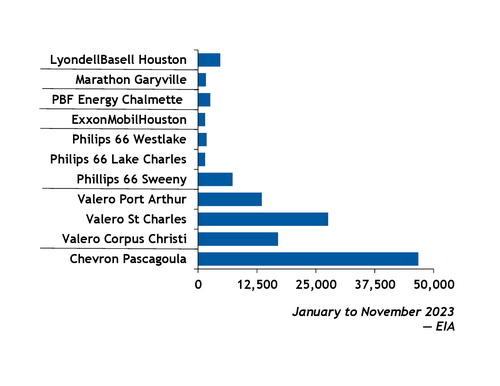

Chevron imported 46,700 b/d ofVenezuelan crude to its 356,000 b/d Pascagoula, Mississippi, refinery, according to US Energy Information Administration (EIA) monthly data spanning January-November 2023. A coke cargo loading from the refinery in the fourth quarter was reported to be just under 6pc sulphur, according to a market participant.

And Phillips 66 imported a total of about 2.4mn bl — or less than 10,000 b/d — of Venezuelan crude to its 265,000 b/d Sweeny refinery in Old Ocean, Texas, once a heavy consumer of Venezuelan crude and mid-sulphur coke producer. The refinery has been able to segregate the mid-sulphur-quality coke from higher-sulphur production and market it separately. Of this refinery's projected annual production capacity, approximately 14pc is expected to be mid-sulphur quality, according to a market participant. But the lower-sulphur quality is not consistently produced, occurring in batches, as the refiner imported the Venezuelan crude sporadically.

But other US refiners like Marathon Petroleum, PBF Energy, and ExxonMobil have not imported Venezuelan crude frequently enough to have an impact on coke sulphur content.

Valero was a relatively frequent importer, taking 50,900 b/d of Venezuelan crude from January-November. But it divided the volumes between its 335,000 b/d Port Arthur, Texas; 215,000 b/d St Charles in Norco, Louisiana; and 290,000 b/d Corpus Christi, Texas, refineries, diminishing the crude's impact on coke sulphur content.

The impact of Venezuelan crude imports on US coke quality in the past year has also been limited as a result of the crude being largely absorbed by China. In 2023, China was the top importer of Venezuelan crude, imported approximately 390,800 b/d, compared with the 128,900 b/d imported to the US Gulf Coast, according to preliminary data from Vortexa.