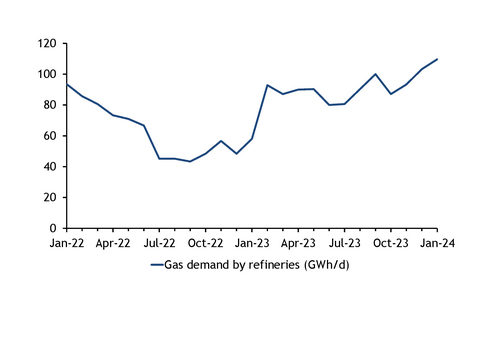

Spanish gas demand in refineries hit a two-and-a-half-year high in January, as a seasonal rise in refineries' output increased the ceiling for natural gas use and followed a switch back to natural gas from LPG as a feedstock over the past year.

Natural gas may remain Spanish refiners' feedstock of choice in the coming months judging by forward prices, although the sector's overall gas use may fall as seasonal refinery maintenance picks up in the coming months, trimming refinery run rates.

Gas demand by Spanish coke and oil refineries, the largest industrial gas-consuming segment in the country, reached nearly 110 GWh/d last month. This was the highest since August 2021, and nearly double the 58 GWh/d in January last year (see graph). Refineries alone accounted for more than 10pc of aggregate gas demand in Spain last month.

Refineries are highly energy-intensive facilities, requiring a large amount of heat and power to propel crude furnace and distillates oil products. Natural gas is also used as a feedstock to produce hydrogen and is used in hydrocracking — which splits heavy hydrocarbon molecules into lighter fuels such as diesel. And refiners feed natural gas into desulphurisation units, which are used to reduce the sulphur content of transport fuels to conform to environmental standards.

Refinery utilisation rates in Europe tend to peak around December and July, as seasonal maintenance and a slowdown in output is typically concentrated in the spring and summer. Greater refinery utilisation entails a higher floor for natural gas demand. And refiners across EU-15 countries and Norway ran their plants at 84pc of capacity in January, the highest in a year, according to Euroilstock data. This was almost in line with the 85pc maximum for European refining assets that has not been surpassed in recent yeas, given increasingly old and inefficient assets.

Besides higher refinery run rates, fuel switching has been another key driver of growing gas use by this industry. Refinery furnaces can have a degree of flexibility in the fuels they burn, at times transitioning from natural gas to LPGs such as propane, or even naphtha or refinery residuals.

A fall in Spanish gas prices over the past year has led refineries to switch back to natural gas as the main fuel for distillation processes after replacing it with alternative fuels in 2022, Spanish petroleum refiners association AOP told Argus today. The Argus Spanish PVB front-month gas contract fell sharply from an average of €105/MWh in 2022 to €42/MWh in the first half of 2023 and €37/MWh in the second half of the year. And even lower prices could encourage refiners to stick with gas later in the year. Argus assessed the PVB summer 2024 price at an average of €27/MWh on 1-13 February.

And while historically firm margins for refined products have discouraged the use of naphtha as a feedstock for some time, firmer prices for LPGs this winter might have encouraged some switching at the margin back to natural gas more recently. Argus assessments for large propane cargoes in the Amsterdam-Rotterdam-Antwerp area averaged more than $500/t in January, down from $620/t a year earlier but up from $420/t in June.

A reduction in refinery residue — which can be burnt in the furnace instead of natural gas — could further explain the rise in gas use, as European refineries have been running increasingly lighter and sweeter crude slates following the exit of Russian Urals crude from the EU market more than a year ago. Lighter, sweeter crudes leave less refinery residue behind. That said, lighter, sweeter crudes also require less desulphurisation and hydrocracking to yield higher proportions of lighter products — processes which use hydrogen derived from natural gas — which could have balanced out the effect of reduced residue.