The government wants to bring down the cost of subsidising cylinder use even as butane demand continues to rise, writes Efcharis Sgourou

Morocco's government is moving ahead with plans to phase out direct butane subsidies to reduce its budgetary allocation. Its intention to gradually reduce retail LPG price controls could in theory pressure domestic sales, although Rabat plans to replace the blanket measure with more targeted cash subsidies for low-income users, potentially softening the blow.

Retail butane prices in the country — Morocco consumes mainly butane for residential use, with more than 2.6mn t/yr of demand — for a 12kg cylinder have stood at 40 dirhams ($4) since the 1990s under the government's subsidy programme. This price will rise by Dh10 in April, another Dh10 from 2025 and another Dh10 from 2026 to reach Dh70. These prices equate to $331/t now, rising to $413/t in April, $496/t by 2025 and $578/t by 2026. The government's reform does not indicate any further increase in the price cap beyond 2026, but if it grew at the same rate the subsidy would effectively be scrapped by 2030.

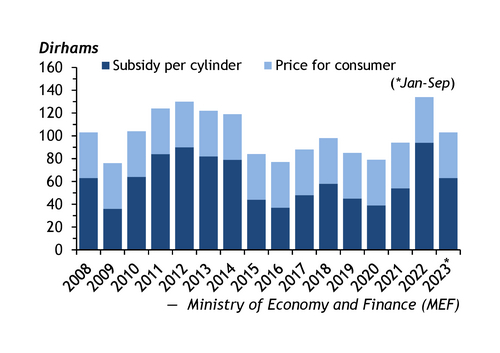

The cost of the subsidies to the government have fluctuated over the years depending on the price of butane imports to Morocco and the level of domestic demand. The cost of a 12kg cylinder increased to Dh90 in 2012 before declining to Dh37 by 2016, and then fluctuating moderately over the next five years, according to the finance ministry. But it surged to a new high of Dh94 in 2022, representing more than 70pc of the total cost of the product sold.

The cost of a 12kg cylinder fell to around Dh68 in the first three quarters of 2023, meaning the government spent around Dh5,666/t, or $560/t, on LPG subsidies. Based on residential demand, this equates to a total subsidy bill for LPG of about $1.1bn. The hope for the government is that LPG prices do not climb significantly above current levels, allowing them to trim this bill by more than 40pc over the next two years.

Moroccan prime minister Aziz Akhannouch said in October the government would reduce subsidies for LPG by Dh3bn to Dh16.4bn this year. Akhannouch is a billionaire businessman and chief executive of conglomerate Akwa Group, the owner of Afriquia Gaz, one the country's main LPG importers and distributors.

The subsidy reforms are designed to be targeted by diverting some of the subsidies that presently benefit the commercial sector and more affluent consumers to low-income households through cash transfers — similarly to the Indian government's PMUY scheme. Rabat plans to allocate Dh25bn this year in financial aid to families affected by the devastating earthquake in the country on 8 September 2023. This will also be used to help soften the blow of rising LPG prices for low-income households, although the government has not provided details on how much of the budget will be used for LPG prices.

Formula change?

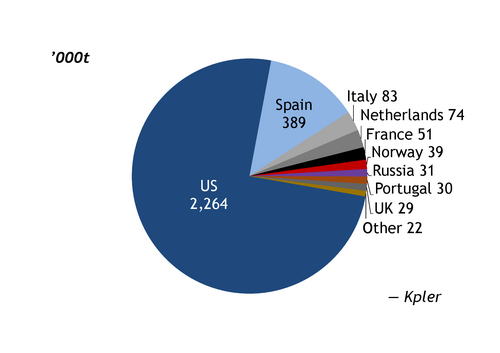

The decision to phase out subsidies was largely anticipated by European and Moroccan market participants, but they are uncertain how the move will impact Morocco's LPG import price formula for tenders and spot purchases. The formula was updated at the start of this year to 70pc US Gulf coast export prices plus freight, and 30pc northwest Europe and Mediterranean coaster prices plus freight, from the previous 50:50 split.

Parliamentary talks on removing energy subsidies have gained momentum since 2017 when the country was spending around $1.2bn/yr on them and when Mediterranean butane coaster prices averaged $505.50/t fob Lavera. But waning support for the government that eventually lost the 2021 general election stalled the move, while butane coaster prices rose to $788/t fob Lavera in 2022 and Morocco's energy subsidy spend exceeded $3bn. The country's new pro-business government is now in a better position to implement the measure.