Output from the South Pars field continues to rise and Iran has expanded its export capabilities to further feed China's PDH sector, writes Ieva Paldaviciute

Iranian LPG exports are expected to continue increasing until at least the end of this decade, despite US sanctions on the country's energy and banking sectors that could face renewed vigour if Donald Trump is re-elected in November.

Iran's LPG exports rose by 2.6mn t on the year to almost 11.4mn t in 2023, according to consultancy FGE, which expects them to grow by 600,000t this year. This is higher than data from Kpler, which puts exports at 10.4mn t, up by 1.9mn t, and would make Iran the largest LPG exporter in the Mideast Gulf for the first time.

Iran's exports hovered at around 5mn t/yr over 2018-20, demonstrating the rapid growth in the three years since, driven primarily by rising LPG output, around 80pc of which is from gas processing. Iran is an Opec member but is not bound by Opec+ crude production restraints. US sanctions that have been in place since 2018 when Washington withdrew from the 2015 Joint Comprehensive Plan of Action (JCPOA) nuclear deal initially restricted Iran's crude and oil products production and exports. But natural gas output from the giant South Pars field has continued to rise, and with it production of natural gas liquids (NGLs).

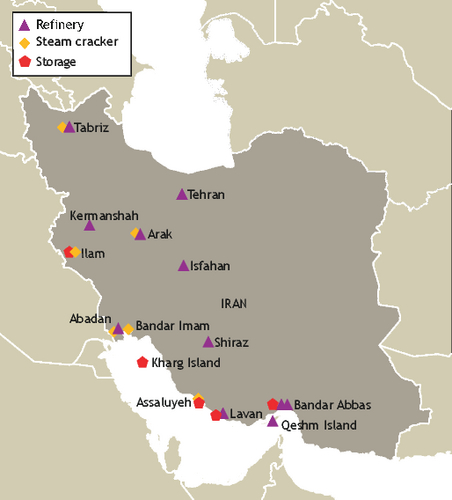

Iran's LPG production rose by around 77pc to 429,000 b/d (13.5mn t/yr) between 2020 and 2023, FGE data show, driven largely by rising South Pars gas output. All of the field's 24 phases are now producing, the last of which, 11, started up last year. Increasing crude output and exports since the start of last year further lifted gas and associated gas output, and so too LPG yields.

Iran has also expanded its VLGC fleet and upgraded its export terminals, enabling it to ship more LPG. China is the dominant buyer, taking 8.9mn t, or 78pc, of Iran's LPG exports in 2023, Kpler data show — India took 945,000t, with the rest mostly heading to Yemen, Bangladesh, Pakistan and Turkey. China's growing LPG-fed petrochemical capacity and fleet of VLGCs has encouraged it to buy more cheap Iranian supply, with discounts to fob Saudi Aramco contract prices (CP) peaking at $100/t for large refrigerated cargoes and $420/t for smaller pressurised shipments in 2022. "These high discounts helped Iran expand its market in China," FGE says.

Discounts narrowed last year as demand for Iranian LPG grew, but they have widened again this year. "Refrigerated cargoes now land in south China at a cif price of $40-60/t above CP, which is still competitive compared with cargoes from neighbouring countries in the Mideast Gulf," FGE managing director for the Middle East Iman Nasseri, says. China's LPG demand is likely to expand significantly again this year, which will further support trade with Iran, whose LPG exports are expected to grow to 17mn t/yr by 2030 and production to 636,000 b/d, FGE says.

Trump resurrection

Iran's energy exports recovery has been on the US' agenda since the Israel-Gaza conflict began. President Joe Biden took office in 2021 intending to de-escalate tensions with Tehran and pave the way for a return to the JCPOA. But talks broke down in 2022. Iran's exports rise has been explained by less-stringent sanctions enforcement by the US. Iran and the US held indirect talks recently about "sanctions relief negotiations", according to state news agency Irna, with the US said to be using it as leverage to get Tehran to prevent Yemen's Houthi militants from attacking ships in the Red Sea. Washington has not confirmed these talks.

But the US presidential election is due in November, with Donald Trump — the architect of the US withdrawal from the JCPOA and the renewal of sanctions in 2018 — slightly ahead in most polls. Even if Trump wins and takes steps to toughen sanctions, the impact on Iran will be limited, Nasseri says. "We are unlikely to return to [lower] 2018-20 export levels. Iran has really expanded its ‘middlemen' network in the past few years, as well as its fleet, making it really hard to track the origin of Iranian cargoes."