The German power spot index has delivered below over-the-counter (OTC) expectations in April as wind and solar output have averaged above seasonal norms. But forward prices suggest that the spot index is on track to deliver above OTC expectations on declining wind generation in the second half of the month.

The German spot index averaged €50.49/MWh over 1-16 April, below the April OTC contract's expiry of €54.90/MWh. But the index is on track to deliver at around €58.46/MWh across the month, based on the weighted-average of the expiry of week 16 at €65.70/MWh and the latest assessments of weeks 17 and 18 at €71.20/MWh and €59.50/MWh, respectively, and the spot index in April.

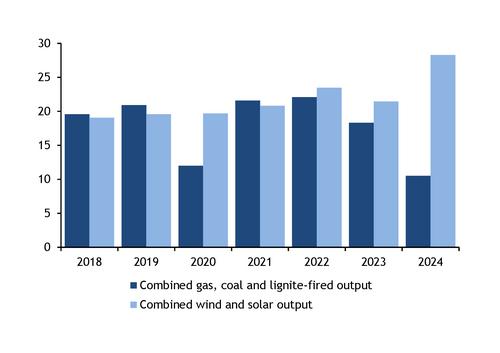

Combined onshore and offshore wind generation has climbed to 19.65GW this month, well above the 13.4GW average for April 2019-23. And solar output has averaged above 8.6GW, a new high for April.

Rising renewable output has weighed on thermal generation, with combined gas, coal and lignite-fired output down to 10.5GW, the lowest of any month in over seven years. Working day-ahead clean dark spreads for 40pc-efficient plants have averaged minus €28.46/MWh for delivery on 1-15 April from minus €13.88/MWh in March. Clean spark spreads for plants with 55pc efficiency have fallen by €14.68/MWh on the month and into negative territory at minus €11.17/MWh. And clean lignite spreads for 36pc-efficient plants have averaged minus €13.51/MWh from €0.29/MWh last month.

The seasonal rise in temperatures has also lowered demand by 1.6GW on the month to 50.35GW in April, outpacing the month-on-month decline in generation by over 300MW. And Germany has been a net exporter on six days this month, compared with seven days in all of March.

But wind output is forecast to remain below the 2019-23 average on most days in the second half of the month, data from analytics platform Kpler show, while peak-load solar output is expected to remain below a load factor of 30pc — or 16GW — over 16-21 April, which could support the spot index and imports.

And the May contract rose to its highest in almost three months on its latest assessment on 12 April at €64.60/MWh, up from under €50/MWh on its first assessment as the front month. Thermal generating margins for base and peak-load delivery in May have averaged well below zero in April, with even higher-efficiency coal, lignite and gas-fired plants priced out of the mix.

Germany is likely to continue importing from its Swiss and French neighbours in May. Swiss hydropower stocks widened their surplus to the long-term average in week 14, while precipitation in Sion is forecast well above seasonal norms next month and Alpine snowpack is well above average, which could boost inflows when snowmelt picks up in May. And French nuclear unavailability is forecast to drop by 4GW on the month to 15.6GW in May, well below the 25.4GW in May last year.