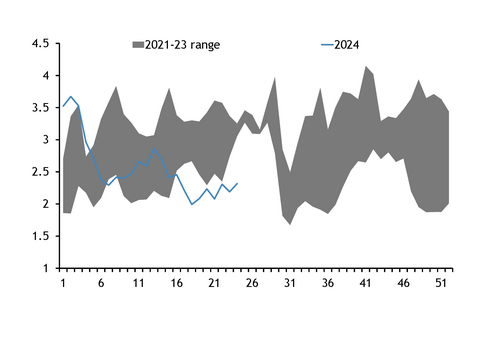

Coal stocks at South Africa's Richards Bay Coal Terminal (RBCT) increased to 2.3mn t in the week to 17 June, after freight rail performance stabilised with no disruptions, and even as exports from the terminal increased slightly.

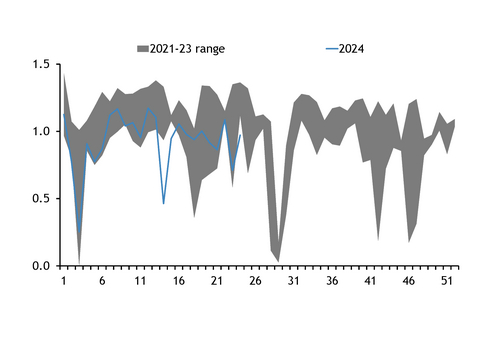

Rail deliveries to the terminal totalled 971,000t for the week, picking up from a nine-week low of 709,000t in the week ending 10 June. The terminal will be looking to continue building inventory ahead of rail lines shutting for annual maintenance on 9-18 July.

Stocks at RBCT rose by 111,000t on the week to 2.3mn t, in line with a rebound in rail shipments to the port. However, stocks have been trending down this year after opening at 3.7mn t in January and are expected to fall even lower when rail lines shut for maintenance next month.

Low stocks have resulted in limited spot offers because sellers cannot guarantee timely delivery — there have been no offers in the NAR 6,000 kcal/kg fob Richards Bay physical market since 10 June.

Weekly rail deliveries to RBCT have averaged 927,000t in 2024, equivalent to 48.2mn t on an annualised basis. This is a slight improvement compared with 47.7mn t in 2023, but still significantly down from pre-Covid-19 levels of 60mn-70mn t/yr.

Freight rail performance remains a key concern for South African coal producers, with Thungela expecting its on-mine inventory to increase by about 1.1mn t to the end of the year based on current Transnet Freight Rail run rates.

Meanwhile, exports from the terminal rose to 818,000t, up by 73,000t from the previous week. About 600,000t was headed to India, with smaller volumes bound for the Netherlands and Pakistan, data from Kpler show.