Coal burn in the US' two largest electric grids climbed in June as a heatwave spurred an uptick in cooling demand.

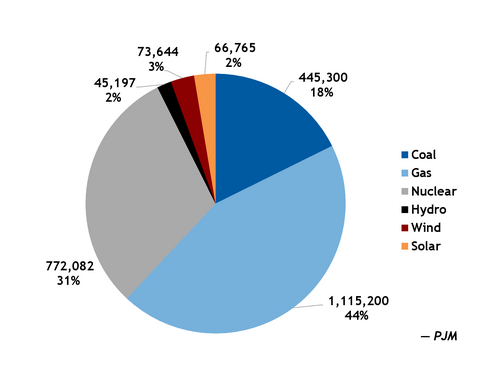

Generators dispatched 445,300 MW/d of coal power into the PJM Interconnection during the month. That was 55pc more than in June 2023.

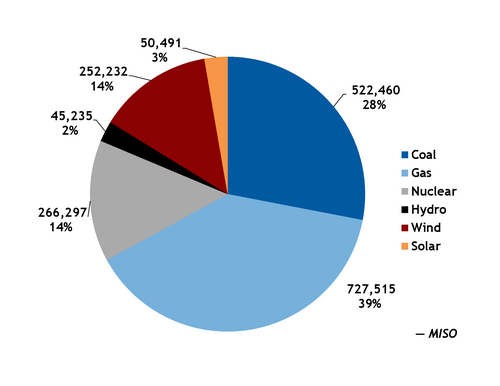

Average coal-fired generation into the Midcontinent Independent System Operator (MISO) increased by 1.5pc on the year prior to 522,460 MW/d in June.

The increases in coal power dispatch were mostly in the middle of June as a heatwave stretched across the eastern and central US. The hotter weather, which in some cases included temperatures close to record highs, had the greatest effect on electricity demand in PJM, MISO, the Independent System Operator for New England, and the New York Independent System Operator, according to the US Energy Information Administration (EIA).

The grid operator issued a number of weather alerts and warnings that were in affect from June 17-26. During the heat wave, peak electricity demand each day was between 1pc and 24pc more than the maximum of any June day in the previous five years, EIA said. PJM forecast peak summer demand in its 2024 summer outlook to be 151,000MW.

Total power dispatch in PJM climbed to nearly 2.97mn MW on 21 June, the highest levels since January, and was only slightly lower than that on 18-20 June and on 22-25 June. In most of the back half of the month, generators ran coal units in PJM at a greater capacity than they had in June 2023.

Coal-fired generation in PJM reached a five-month high of 611,697MW on 19 June and topped 600,000MW again on 21 June, data from the country's largest grid operator showed.

For June as a whole, average coal-fired generation accounted for 17pc of PJM's total dispatch, the most since January. Coal's share in PJM was also 5 percentage points higher than in June 2023.

In MISO, the nation's second-largest electric grid, coal's average share of the grid's electricity dispatch slipped by one percentage point on the year prior, to 28pc in June despite coal-fired generation being higher. During the height of the heatwave, 17-25 June, overall power dispatch in MISO was above 2mn MW on all but one day. And coal-fired generation climbed to a five-month high of 686,289MW on 19 June.

Natural gas-fired generation in PJM and MISO was mixed, rising in PJM and falling from year earlier levels in MISO. But the fuel lost market share in both grids. Gas accounted for 43pc of total generation in PJM and for 39pc in MISO, down from 46pc and 44pc, respectively, in June 2023.

Gas' dominance in PJM and MISO decreased despite mixed movements in gas prices last month. The day-ahead natural gas price at the Chicago Citygates dropped to $1.971/mmBtu from $2.07/mmBtu in June 2023. On the other hand, the day-ahead price at the Henry Hub averaged $2.525/mmBtu in June, up by 16pc from the same month in 2023.

Renewable generation rose in both grids, as did their share of PJM and MISO's fuel mix. That at least partly reflected projects that have been added in PJM and MISO over the past year.

Coal-fired generation in the two grids eased at the very end of the month, but it could be mixed in the near term. National Oceanic and Atmospheric Administration models suggest a hotter-than-normal weather pattern during the next two weeks will be interrupted at times by cooler weather in the midcontinent. But heat otherwise projected to dominate across most of the US on 8-26 July, according to forecaster.