US power plants received more Powder River basin (PRB) and Northern Appalachian coal last quarter than they had a year earlier as they worked to meet great-than-expected coal-fired generating demand.

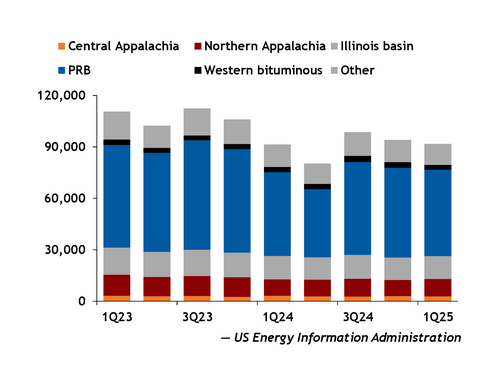

The rise in PRB and Northern Appalachian coal receipts was the primary reason that overall shipments to utility-scale coal-fired power plants edged up to 91.7mn short tons (83.2mn metric tonnes) over January-March from 91.4mn st in the first three months of 2024, fuel receipts data from the US Energy Information Administration (EIA) show. Plants also received more coal from Alabama and from lignite mines in Mississippi and Texas, but receipts from Illinois basin and Central Appalachian coal mines lagged year-earlier levels.

Shipments to coal-fired power plants started the year on a downward trend, as market participants waited to see whether colder-than-normal weather and higher natural gas prices would stick throughout the winter. But by February some were reporting increased demand, and in March US-wide power plant coal receipts topped year-earlier levels for the first time since October 2022.

EIA data show power plants receiving more spot shipments of coal in each month of the first quarter than they had a year earlier and greater volumes delivered under term contracts in March. The spot shipment volumes for the quarter rose to 8.02mn st from 7.16mn st and included greater shipments from the Illinois basin in January and February as well as higher PRB and Northern Appalachian coal volumes throughout the first quarter.

Coal shipments by both rail and barge were higher in March than they had been a year earlier, but lower than in the previous two months.

Receipts of PRB and Northern Appalachian coal delivered under term contracts also were higher last quarter than a year earlier.

Overall PRB deliveries to US utility-scale power plants rose by 3.4pc to 50.4mn st last quarter, and Northern Appalachian coal receipts increased to 10.2mn st from 9.54mn st.

Power plants also received more coal from Central Appalachian mines under term contracts, but spot deliveries from those mines decreased, dragging overall receipts from Central Appalachian properties down to 2.8mn st from 3.2mn st. Deliveries from Illinois basin coal mines fell to 13.3mn st from 13.6mn st.

Central Appalachian and Illinois basin coal production last quarter remained lower than year-earlier levels, US Mine Safety and Health Administration data show. In addition, Commerce Department data show thermal coal exports out of the New Orleans, Louisiana, Census district - which is a proxy for Illinois basin exports and some Appalachian exports - were higher last quarter than in the same period of 2024, possibly contributing to less coal being shipped to US power plants.

But those conditions have been changing. Following the greater-than-expected US coal consumption and a downturn in seaborne coal markets, producers are getting higher prices for shipping US coal domestically than into international markets. In addition, separate EIA production data show weekly coal output from most regions topping year-earlier levels since late last quarter.