The premium for fob US Gulf fuel-grade mid-sulphur petroleum coke over high-sulphur coke narrowed last week to its lowest in over a year because of a decline in sulphur content from multiple refineries in the region, increasing mid-sulphur supply while tightening high-sulphur coke spot availability.

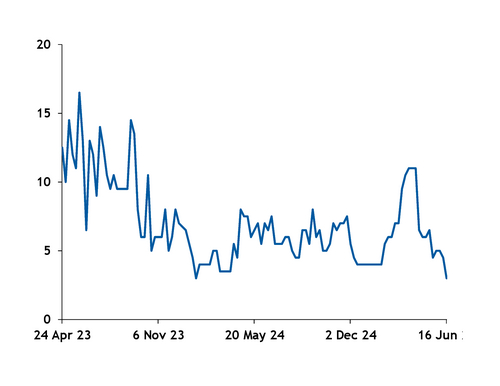

Fob US Gulf coast mid-sulphur coke's premium to the high-sulphur product dropped to $3/t on 18 June, down by $2/t on the week, after 4.5pc sulphur coke prices fell by $2.50/t to $70/t while the 6.5pc sulphur specification edged down by $1/t to $67/t fob. This was the lowest premium since late January 2024. It was also down from $6.50/t the week of 14 May and $11/t on 16 April.

The spread has narrowed mainly because some US Gulf refineries' production has shifted to 4-5pc sulphur coke from 6-6.5pc because of lighter crude slates.

At least three or four refiners in Texas and Louisiana that would typically produce 6.5pc sulphur fuel-grade coke have been producing closer to 5pc sulphur or less, market participants say. As a result, some traders have received mid-sulphur coke that is priced under long-term contracts based on high-sulphur prices. This has provided cushion for them to sell this coke into the mid-sulphur market at a smaller premium, while also boosting spot prices for high-sulphur coke, as they seek to fulfil long-term sales contracts with spot purchases of the more limited higher-sulphur grade.

With spot availability of 6.5pc sulphur tighter and mid-sulphur more widely available than usual, some deals for the two grades have sold essentially at parity. One cement firm purchased a US Gulf high-sulphur coke cargo at $68-69/t fob last week, while a prompt June-loading mid-sulphur cargo was heard selling slightly above $69/t fob over the past week. Some buyers in India, where there is little particular appetite for mid-sulphur coke, have been offered this quality or even had it delivered under high-sulphur contracts.

Both grades have been under pressure recently as freight rates have risen while demand in major consuming markets is fairly subdued on competitive coal and domestic coke prices. At least three Turkish buyers cancelled seaborne coke tenders this month in favour of Russian coal or competing in local refinery tenders, and Indian buyers are also increasing domestic coal purchases.

There are also no signs of recovering demand in the Chinese market. Fuel-grade demand remains subdued in general on low coal prices, while stockpiles have risen on high purchasing in recent months, and many importers have shied away from US coke because of uncertainty around tariffs.