A regulatory mismatch between EU-wide FuelEU Maritime rules and national Renewable Energy Directive (RED III) transpositions in Belgium and the Netherlands is set to disrupt biofuel and marine fuel markets from 2026, particularly in the Amsterdam-Rotterdam-Antwerp (ARA) bunkering hub.

The Dutch and Belgian governments plan to exclude biofuels made from used cooking oil (UCO) and animal fats — listed under RED Annex IX Part B — from counting towards maritime fuel mandates. This contrasts with FuelEU Maritime, which rewards their use to cut shipping emissions. The divergence is expected to distort supply-demand dynamics and raise compliance costs for suppliers and shipowners.

Draft legislation in both countries obliges fuel suppliers to reduce greenhouse gas (GHG) emissions across land, inland shipping and maritime sectors. Under the Dutch RED III draft, Annex IX Part B biofuels — including UCO and animal fats categories 1 and 2 — will count towards land and inland shipping mandates only, capped at 4.29pc and 11.07pc respectively. For international maritime shipping, the cap is set at zero. This means suppliers cannot claim emission reduction units (EREs) for Part B fuels used in maritime shipping, effectively disincentivising UCO-based biodiesel sales in the ARA region.

FuelEU Maritime, by contrast, mandates GHG cuts for maritime users starting at 2pc in 2025, rising to 80pc by 2050, and places no cap on Part B fuels. Like FuelEU Maritime, the Dutch RED III draft excludes crop-based biofuels from counting towards maritime GHG reduction targets. But unlike FuelEU, it also bars Annex IX Part B fuels — creating a sharper compliance gap for bunker suppliers.

This leaves used cooking oil methyl ester (Ucome) in a precarious position. Widely used in marine fuels due to its scale and compatibility with existing engines, Ucome-based blends will remain attractive to shipowners aiming to meet FuelEU Maritime targets. But ARA suppliers will need to sell Annex IX Part A fuels — such as bio-LNG or Advanced Fame 0 — to meet RED III targets or face penalties. This could push up Ucome prices, as suppliers seek to offset non-compliance costs.

Advanced Fame 0-based marine biodiesel blends are currently attractive to buyers because marine mandates have not yet taken effect. Under the existing system, HBE-G renewable tickets — which will be replaced by EREs next year — can be deducted from the price of Part A fuels, but this may not be viable next year. Part B fuels from the marine sector do not currently generate HBEs.

Higher Ucome prices may inflate maritime-generated ERE values and boost demand for Part A fuels, raising overall biofuel costs and reducing ARA's competitiveness. Some shipowners may opt to bunker elsewhere. Many already source marine biodiesel from Asia, where prices are lower. Argus assessed B30 Ucome dob ARA at an average of $805.30/t during May–July, compared with $705.48/t in Singapore.

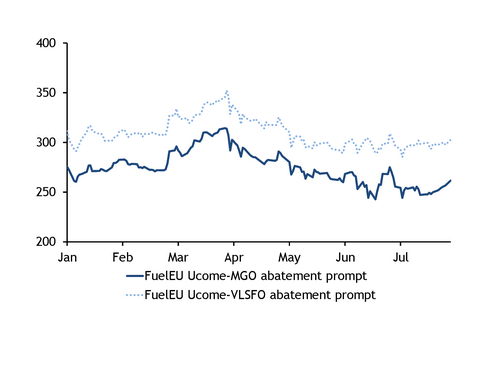

Prices for alternatives like RFNBOs and ammonia remain high, limiting near-term uptake. FuelEU abatement prices for Ucome-MGO and Ucome-VLSFO have been relatively flat this year, but could rise if Ucome prices firm.

Market reactions

Market participants are exploring ways to navigate the mandates. One option is blending small volumes of Advanced Fame 0 into bunker fuels, although this is logistically complex and could raise prices at ARA ports.

Another strategy involves sourcing marine-generated ERE tickets from over-compliant sellers. But supply may be tight, as only a limited share of inland and land-generated tickets can be transferred to the marine sector under the flexible credit allowance.

Some suppliers have told Argus they are considering shifting some of their bunker volumes to other ports, including the Mediterranean region. Spain's RED III draft includes a proposed 1.7pc cap on Part B fuels — far more lenient than Belgium and the Netherlands. Spain's marine mandate starts at 1pc in 2027, rising to just 3pc by 2030.