Mexico's updated climate pledge sets its most ambitious emissions target, but the plan sits in sharp contrast to the government's push to increase crude processing and fuel output at state-owned Pemex's refinery system.

Mexico submitted its new nationally determined contribution (NDC) ahead of this month's UN Cop 30 summit in Belem, Brazil, committing for the first time to an absolute cap on greenhouse gas emissions of 364–404mn t of CO2 equivalent (CO2e) by 2035, or 332–363mn t CO2e with international support. The target represents a cut of more than 50pc from a business-as-usual trajectory, according to the environment ministry, and aligns with Mexico's long-term commitment to reach net zero by 2050.

But while Mexico promises steep emissions reductions, it is simultaneously doubling down on a fossil-heavy industrial strategy centered on reviving its aging refining system, boosting domestic output of gasoline and diesel and limiting private-sector participation across the downstream chain.

Mexico's refineries — most of which regularly run at below 50–60pc of capacity — remain among Mexico's largest stationary emitters, with high rates of flaring, residual fuel oil production and energy inefficiency.

The government has also poured billions of dollars into the new 340,000 b/d Olmeca refinery and continues to prioritize increasing crude throughput at the legacy system, even as maintenance shortfalls, outages and unplanned shutdowns remain common.

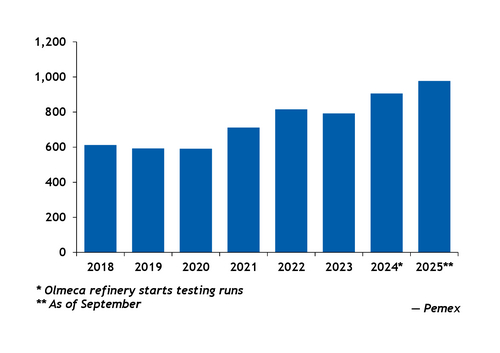

Pemex processed about 950,000 b/d of crude across its seven domestic refineries in September, up by 8pc from a year prior and 57pc higher than the 604,300 b/d processed in September 2018, before former president Andres Manuel Lopez Obrador took office.

Mexico's refining-heavy strategy took shape under Lopez Obrador, who made fuel self-sufficiency the centerpiece of his administration after years of under-investment and declining output at Pemex's refining system.

His government moved away from the 2014 energy reform and proposed constitutional changes that would free Pemex from its obligation to operate as a "productive state company." The shift enabled greater political influence over Pemex's operations and reinforced a nationalistic focus on refining, even as the company posted financial losses and saw its crude output fall to 40-year lows.

President Claudia Sheinbaum's administration has continued that trajectory. Backed by a congressional supermajority that allows her party to advance Lopez Obrador's reforms, Sheinbaum has maintained the emphasis on fuel self-sufficiency and continued to expand Pemex's role through increased state support.

Mexico's NDC frames climate policy as compatible with economic development, job creation and "just transition" principles. But the plan is still vague on specific mitigation actions for the refining sector.

"Mexico's ambition is clear, but delivering on these goals will require deep structural transformation and a clear, sustained investment strategy," said Francisco Barnes Regueiro, executive director of the environmental non-governmental organization the World Resources Institute in Mexico.

Meanwhile, the government maintains policies and proposed reforms that favor Pemex and state utility CFE over private-sector companies, limiting private investment in cleaner fuels and renewable electricity.

The lack of incentives for low-carbon technologies, combined with an aggressive push to increase domestic production of gasoline and diesel, contradicts the technical requirements implied by the emissions cap, according to market sources.

The contradiction becomes more pronounced as Mexico prepares for the Cop 30 negotiations. Mexico, which now joins more than 50 countries that have updated their NDCs, will likely face scrutiny over how its energy agenda fits within its climate ambitions.

For now, the gap between Mexico's stated targets and its refining-focused policy framework remains wide. Without clear measures to reduce emissions from Pemex's refining system, expand low-carbon fuels and introduce stronger regulatory incentives, the new NDC risks becoming another aspirational document.