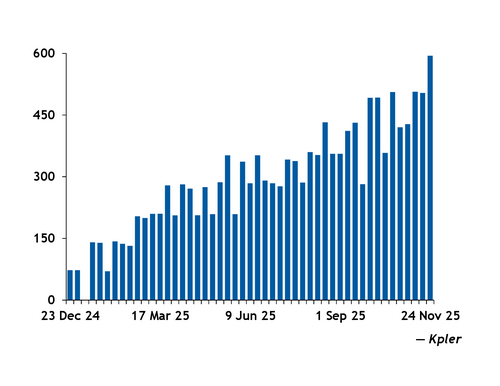

Eight LNG carriers loaded at Venture Global's 27.2mn t/yr (3.6bn ft³/d) Plaquemines export facility in Louisiana in the week that began 24 November, a record for the terminal, ship-tracking data from Kpler show.

The rise is part of the faster-than-expected ramp-up at Plaquemines, which is the second largest US LNG export facility behind Cheniere's 33mn t/yr Sabine Pass terminal. Plaquemines exported 590,000t in the week that began 24 November, raising the four-week moving average to 510,000t (see chart). That would equate to 26.52mn t/yr if annualized, above Plaquemines' nameplate capacity of 20mn t/yr. Plaquemines exported its first cargo in late December 2024 and received federal approval to run feedgas through its final two liquefaction trains in October. Its previous weekly loadings high was seven, which occurred five times between late September and late November.

Venture Global told investors in November that Plaquemines would export between 90-94 cargoes in the fourth quarter. The plant exported 61 cargoes in October-November, Kpler data show, putting it in the middle of the guidance if it exports one cargo per day in December.

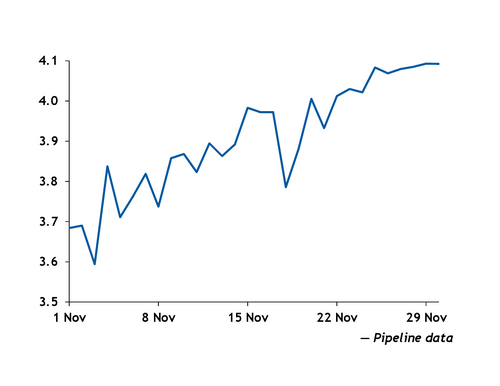

And weekly feedgas nominations to Plaquemines averaged more than 4bn ft³/d for the first time in the week that began 24 November. Flows averaged 4.08bn ft³/d, up from 3.98bn ft³/d the previous week, pipeline data show (see chart). Feedgas nominations to all US LNG export facilities averaged 18.17bn ft³/d last week, though that excludes flows on the 1.7bn ft³/d ADCC pipeline, an instrastate line that connects to Cheniere's 17.4mn t/yr Corpus Christi LNG plant. Instrastate pipelines are not required to publicly post pipeline flows, but export data from Kpler and other pipeline flows to Corpus Christi LNG indicate nominations on ADCC were likely around 700mn ft³/d in November.

The strong pace at Plaquemines is part of higher loading demand in the Atlantic basin than market participants expected, leading to a sharp rise in spot charter rates for LNG carriers in the Atlantic. The Argus Round Voyage rate for two-stroke carriers traveling from the US Gulf Coast to Europe within a 20-45 day period (ARV5) closed at $145,000/d on 1 December, up from $22,000/d on 15 October.