Gas-fired power generation stepped up on the year in 2025 in central and southeast Europe, as gas-fired power plants replaced coal-fired generation and balance the grid as the renewable buildout continues.

Power-sector gas demand has been playing an important role in the transition from carbon-intensive coal generation in the region.

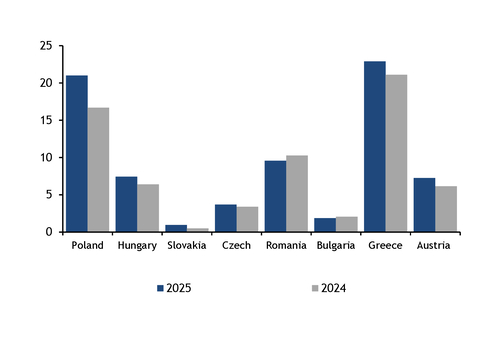

Combined gas-fired generation in central and southeast Europe — Austria, the Czech Republic, Slovakia, Hungary, Poland and Greece — stepped up to 72.8TWh in 2025 from 64.5TWh a year earlier, data from research institute Fraunhofer ISE show (see graph). Romania and Bulgaria were the only countries in the region where gas-fired power generation edged down year on year, having fallen to 9.6TWh and 1.9TWh, respectively, from 10.3TWh and 2.1TWh a year earlier.

Polish gas output rose the most on the year in 2025, to 21TWh from 16.7TWh, followed by Hungary at 7.4TWh last year against 6.4TWh.

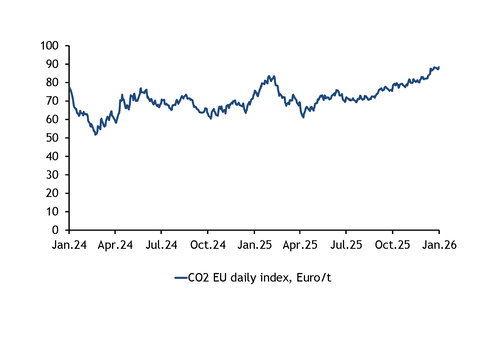

Tighter environmental policies and rising emissions allowance costs are reducing the competitiveness of coal-fired generation relative to gas output. The EU emissions trading systems (ETS) daily index has averaged €74.92/t of CO2 equivalent (CO2e) in 2025 and was €88.49/t on 2 January, substantially above the €66.44/t CO2e in 2024 (see CO2 index graph).

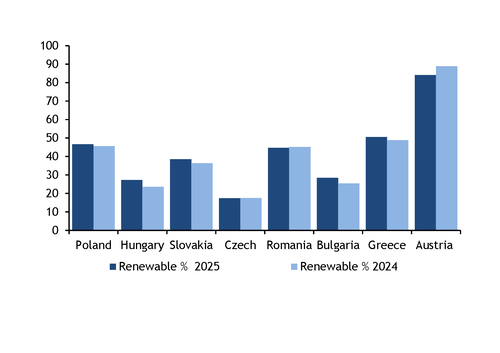

And developers have been prioritising flexible, gas-fired capacity to manage intermittency from the expanding and highly volatile output of solar and wind generation. Renewables accounted for 42.2pc of the regional power mix last year, up on the year from 41.1pc (see renewable output graph). Austria recorded the highest share last year at 84pc, while the Czech Republic had the lowest at 17.7pc.

Regional coal-to-gas switch is ongoing

Several gas-fired power plants are scheduled to come on line this year in Poland, Romania and Greece, replacing coal capacity and supporting power-sector gas demand.

Polish gas demand from the power sector is set to rise further in the coming years because of the planned coal phase-out. Poland's largest electricity producer, PGE, started operations at its 1.4GW Gryfino gas-fired power plant in 2024, which allowed for 450GW of capacity at the Dolna Odra coal-fired station to be taken off line in 2025. The remaining 450MW of capacity at the plant is scheduled for closure in August. PGE also aims to shut its 920MW Rybnik coal-fired plant in 2027, planned to coincide with the commissioning of an 880MW combined-cycle gas turbine (CCGT).

Poland's power system operator PSE plans to upgrade the grid to allow safe system operation without fossil-fuel generation by 2035. Renewable fuels made up 47pc of the Polish power mix last year, one percentage point higher than in 2024 (see graph).

Romania plans to replace all its coal-fired power plants with new CCGT plants and cogeneration units, which may support domestic gas needs in the next few years.

But Romania has renegotiated with the EU to postpone the coal phase-out until the end of 2029 because of slow progress building gas-fired plants. Romanian gas generation capacity is set to grow, because several CCGT units are scheduled to be commissioned this year. The 430MW Lernut CCGT start-up is expected in the second quarter of 2026. The 1.75GW Mintia CCGT is due to come on line by the end of year, while an 850MW CCGT plant is also planned at Isalnita. And a 53MW gas-fired combined heat and power plant is scheduled to begin operations by June. Romania's reliance on gas for power generation is likely to increase further in the coming years because the 700MW unit at the Cernavoda nuclear plant is scheduled to shut down for modernisation in 2027-29.

Greek gas power output was the highest in the region, having increased to 22.9TWh in 2025 from 21.1TWh in 2024. The country aims to phase out lignite-fired generation by the end of this year and has already started replacing its last lignite-fired plant — the 660MW Ptolemaida 5 — to an open-cycle gas turbine. The 810MW Komotini CCGT is undergoing testing and should start commercial operations this year.