The deal creates a top shale producer with core assets in the most sought-after basin, writes Stephen Cunningham

Deal-making in the US shale patch is back on the agenda following shale giant Devon Energy's agreed $21.5bn all-stock acquisition of fellow independent producer Coterra Energy to create a Permian powerhouse.

The biggest US upstream deal in recent years follows a relative lull since a series of mega-mergers led by ExxonMobil and Chevron kick-started the latest round of consolidation in late 2023 and into 2024. More may follow as firms that missed out on the initial wave look to catch up with their rivals and seek opportunities to slash costs and build scale while the shale sector shows signs of fatigue.

The acquisition boosts Devon's position in the Delaware portion of the Permian basin of west Texas and southeast New Mexico. It is also an example of multi-basin deal-making, which is becoming the norm as the shale patch becomes increasingly congested, with fewer opportunities to gain a foothold in a single region. "The combination of these two outstanding companies creates a clear path to superior value creation that neither company could achieve independently," says Devon chief executive Clay Gaspar, who will take on the same role at the merged company.

The real prize in this case may be the expanded Delaware holding, according to energy consultancy Enverus. "The Delaware basin, and particularly the northern portion located in New Mexico, holds some of the best quality rock in North America and from an investor's perspective a company can't have too much exposure there," Enverus principal analyst Andrew Dittmar says. "It is also a hotbed for resource expansion, with Coterra one of the companies leading the way on unlocking new zones."

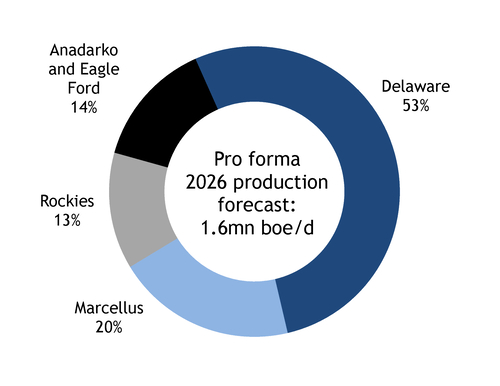

The deal creates one of the top shale producers, with more than 1.6mn b/d of oil equivalent of output as well as around 750,000 net acres (30,0000 hectares) in the core of the Delaware. "This vast leasehold position provides us tremendous operational flexibility and immediate opportunities to drive down well costs and refine capital allocation," Gaspar says. The Delaware will account for more than half of production and cash flow at the new firm, with over 10 years of top-tier inventory, including the largest amount of sub-$40/bl inventory in the sector.

With Devon having a presence across various basins, it could also trigger asset sales going forward. Deal-making still has further to run even if opportunities may be more limited than before. "With fewer obvious targets left, corporate deal-making from here is likely a slow, methodical grind of finding the right partner at the right point in time," Dittmar says.

Peak practice

The latest transaction comes as US crude output is forecast to decline in 2026 from last year's record high. Despite all the gloom surrounding the outlook for shale, it may still be too soon to call a plateau. "I would be slightly more optimistic," trading firm Gunvor's global head of market research and analysis, Frederic Lasserre, said at the Argus Americas Crude Summit in Houston, Texas, this week. "We have always underestimated the impact of productivity gains." The consolidation from a number of large mergers among shale producers has yet to deliver all the productivity benefits many expect, while the application of artificial intelligence by operators may also help, Lasserre said.

Devon is targeting $1bn in annual pre-tax savings from the deal by the end of 2027. The combined entity will be based in Houston but retain a significant presence in Oklahoma City. Devon shareholders will own about 54pc of the new company, while Coterra investors will hold the remaining 46pc. The deal has been approved by both firms' boards and is expected to close in the second quarter.