Norwegian fertilizer producer Yara reported higher fertilizer deliveries and production in 2025, following strong demand in the fourth quarter ahead of implementation of the EU's CBAM.

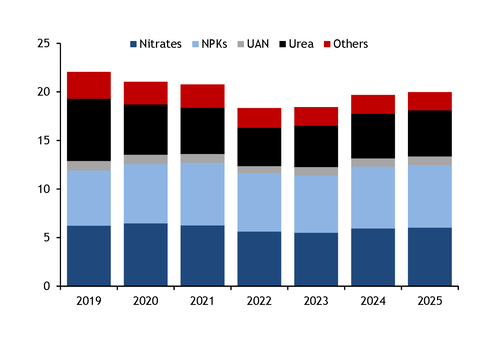

Total fertilizer deliveries — including urea, nitrates, NPKs, CN, UAN, potash and phosphate products — for full-year 2025 rose by 4.1pc to 23.8mn t, up from 22.8mn t a year earlier.

Deliveries to Europe during the year rose by 5pc to 9.1mn t, from 8.6mn t in 2024, while Yara's deliveries to the Americas rose by 5.8pc to 10.2mn t last year from 9.6mn t the prior year. The producer pointed to higher external sales in the Americas.

Deliveries rose by 3pc to 5.7mn t in the fourth quarter, with Europe marking the strongest regional increase from a year earlier. European deliveries rose by 5pc to 2.27mn t on the year. The rise was partially driven by increased pre-buying ahead of the EU's carbon border adjustment mechanism (CBAM), which came into effect on 1 January.

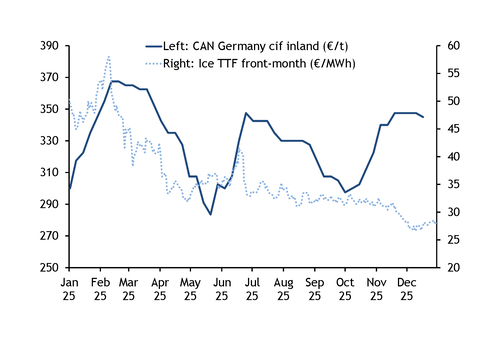

European nitrogen prices rallied in the fourth quarter when buying picked up, while production costs fell. The key European fertilizer price benchmarks German CAN, French UAN and French granular urea rose by an average 13pc in November from the prior month. Natural gas prices fell by 4pc over the same period.

This dynamic supported Yara's earnings, both for the quarter and the year: The company's overall 2025 profits after tax rose to $1.37bn from $15mn in 2024. Its revenue rose to $15.6bn last year, up from $13.9bn in 2024, while operating costs rose to $14.14bn last year from $13.25bn in 2024.

Meanwhile, fourth-quarter profits after tax rose to $344mn, swinging from losses of $290mn a year before.

Fertilizer production recovered some of the previous years' losses, ending the year at 19.98m t, up by 1.5pc from the year earlier, which Yara attributed largely to new production records set by the producer's flagship NPK plant in Porsgrunn, in southern Norway. Fertilizer production was higher than in previous years but remained below levels from before 2022, with 2021 output at 20.77mn t.

In 2026, Yara is planning to commission capabilities for carbon capture and storage (CCS) at its ammonia plant in Sluiskil, in the Netherlands. Yara is also in negotiations for a project with US gas company Air Products. The firm in 2025 signed a 10-year offtake agreement with developer Atome for 260,000t/yr of low-carbon CAN from Atome's Villeta project in Paraguay.

But Yara has indicated that recent confusion over a possible CBAM suspension could slow investment decisions.