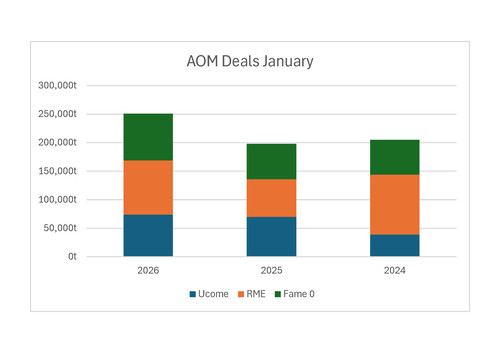

European biodiesel trades initiated on Argus Open Markets (AOM) rose to a two-year high for the month in January (see chart), driven by tightened rules on the carry-over of renewable fuel tickets and by sharp policy shifts as some EU member states rolled out the bloc's revised Renewable Energy Directive (RED III).

Trade in January is often tepid, as firms tend to focus on closing out the past year's compliance balances. But this year, trading activity increased in January due to higher mandates and the removal of double counting for waste-and residue-based biofuels in key European markets under the transposition of RED III.

Initiated trades for the month were only bettered in the eight years of Argus data by January 2023.

Transport mandates under RED III rise sharply, to a 14.5pc GHG emissions reduction, or 29pc renewable energy content, by 2030, driving increased trade as more supply is required to cater to these targets.

In the longer-term view, the German cabinet passed a law in 2024 that scrapped the option to carry over surplus greenhouse gas (GHG) reduction certificates from 2024 into 2025 and 2026, starting both of those years with a clean slate. This pushed buyers to secure more physical product to meet yearly targets instead of relying on excess tickets.

The German move came after a surge of Chinese waste-based biodiesel imports in 2023, which was eligible to be counted twice and had listed strong GHG savings under the German scheme, yielding a large oversupply of tickets across 2024. Many firms chose cheaper tickets over physical fuel, but starting from scratch brought back the need to use actual biofuels to meet the GHG reduction quota.

Why not last year?

The ticket carry-over was set at zero in 2025 and in 2026, but last year the expected increase in buying was countered by uncertainty surrounding US biofuel policy.

Buyers held back while seeking guidance on the 45Z clean fuel production tax credit, which rewards US biofuel makers on a carbon intensity basis and was only issued with formal guidance in the final weeks of the Joe Biden presidency. After taking office, Donald Trump halted funding for 45Z, and rules around which feedstocks would be eligible — alongside constantly changing tariff rates — came up for debate. This led to prolonged uncertainty for the European market, which competes with the US for feedstocks from Asia-Pacific.

The lack of clarity prevented many European participants from taking major positions in the start of 2025, instead pushing back trading to later in the year.

Some uncertainty remained in place thorughout 2025 and into the start of 2026, but lessened as the US biofuel policy under Trump became clearer.

RME leads the pack

Trade initiated in rapeseed methyl ester (RME) rose the most on the year in January, and it remained the most traded grade due to the German transposition of RED III.

The end of double-counting for advanced waste feedstocks in Annex IX part A of RED is set to steer buyers toward crop-based biodiesel in 2026. Germany plans to scrap double counting, pushing firms to buy more physical biofuels to meet the GHG reduction quota.

Market participants are likely to lean more on hydrotreated vegetable oil (HVO) than used cooking oil methyl ester (Ucome) to fill the cap on Annex IX part B fuels, which includes used cooking oil (UCO). HVO, as a drop-in fuel, sidesteps the blend wall that restricts how much biodiesel can be blended into diesel, which means it is necessary to meet higher targets.

Some buyers are turning to lower-priced and more abundant crop-based biodiesel to meet rising mandates, as the crop cap is much higher than the 9B cap in Germany. RME's low cold filter plugging point (CFPP) — the lowest heat at which diesel flows through a filter without clogging — raised demand through the winter.

Still, RME's trading activity in 2026 sits below 2024 levels. High supply in 2023, driven by a strong rapeseed crop harvest and firm production margins, led buyers to hold off for early 2024 in hopes of lower prices.

The average Argus-assessed RME outright value dropped in January 2024 by 40pc on the year to $1,198/t.