The global polyolefin market remains under heavy pressure from persistent oversupply, sluggish demand, trade tensions, and macroeconomic uncertainty. Southeast Asia, as part of the global value chain, cannot escape these challenges. Oversupply and margin compression are expected to persist, while sustainability requirements are increasingly reshaping industry dynamics.

Present Market Imbalances and Regional Strains

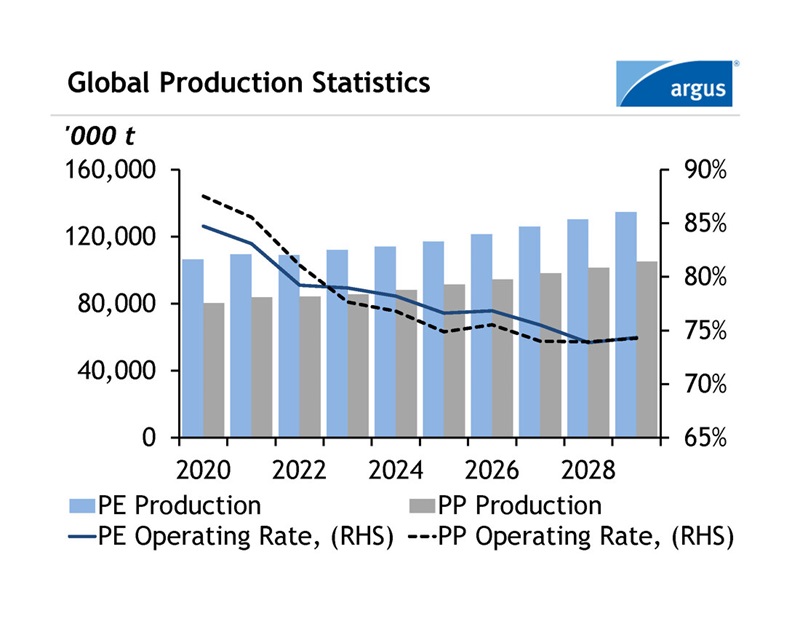

The global polyolefin market is firmly oversupplied. Polyethylene (PE) capacity expanded by 21mn t over the last five years, growing at a 3.8pc compound annual growth rate (CAGR) while demand rose by only 1.9pc. Polypropylene (PP) capacity increased by 24mn t at a CAGR exceeding 5pc, while demand rose by just 2.2pc. This imbalance has pressured operating rates with global operating rates falling from the mid‑80pc range in 2021 to 77pc for PE and 75pc for PP in 2025.

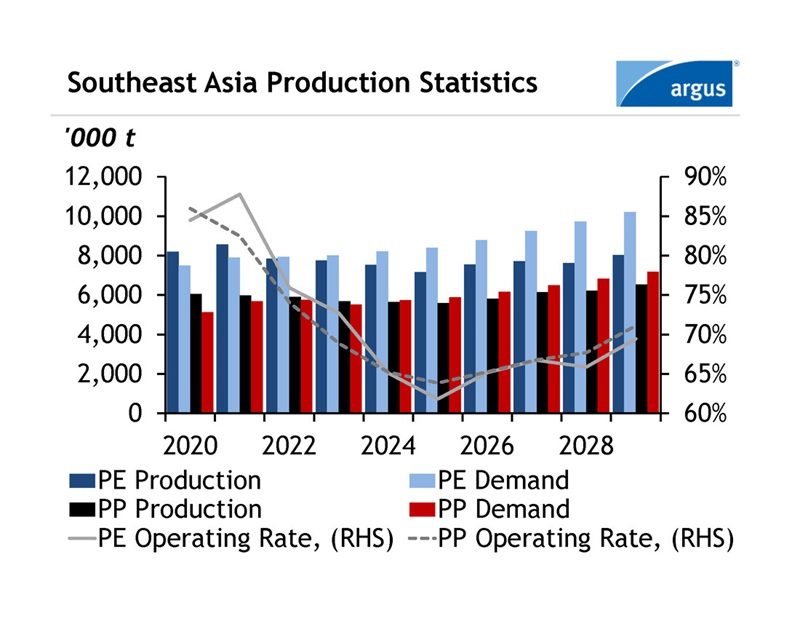

Southeast Asia has also seen significant capacity growth. In 2023, Vietnam’s Long Son Petrochemical started two 500,000t PE plants, while JG Summit in the Philippines added a 250,000t HDPE unit. In 2025, Lotte Chemical Titan commissioned a 250,000t PP plant in Indonesia.

Regional demand growth, however, has remained subdued. Demand grew by 2pc for PE and 4pc for PP in 2024, and by around 2pc for both in 2025. Operating rates have fallen to 62pc for PE and 64pc for PP, reflecting slower consumption and increased production. Regional polyolefin trading activities have seen a reduction in exports and an increase in imports, especially from China, which has led the global polyolefin expansions over the past five years with 11mn t of PE and 17mn t of PP capacity added. Tariffs announced by the US have increased trade risks and uncertainties as well. Tariffs on southeast Asian exports to the US now stand at 19pc for Malaysia, Thailand, the Philippines and Indonesia, and 20pc for Vietnam.

Margin pressure has forced several shutdowns in 2024. Vietnam's Long Son Petrochemical shut its cracker and associated polymers units in October 2024, but it is now operational. Both the Philippines' JG Summit and Malaysia’s Lotte Chemical Titan also announced shutdown plans in December 2024 for the same reason. JG Summit is the first site in the region to be idled without any announced restart plans.

Outlook: Demand Recovery vs. Capacity Expansion

The global polyolefin environment remains highly competitive, and southeast Asia is in a vulnerable position with slower demand growth and weak operating rates. Over the next five years, these pressures are expected to persist, leaving limited near-term relief.

Looking ahead, global demand is expected to expand at a 3.5pc CAGR each for both PE and PP through 2029. Southeast Asia is expected to indicate a stronger growth at 5pc CAGR, supported by stronger economic growth and favourable demographics.

On the supply side, a second wave of capacity additions is expected in 2027-28, with 23mn t of PE and 15mn t of PP capacity entering the market. Global operating rates are projected to bottom out at 74pc during this period, before recovering post‑2029 as demand gradually absorbs excess supply. China will lead the way, with 10mn t of new PE and PP capacity, while the US will add two 1mn t HDPE plants for exports. The Middle East will contribute another 4mn t in the UAE, Qatar, and Saudi Arabia.

Even though there will be limited capacity expansion in southeast Asia through 2029, the global capacity additions are expected to intensify regional competition. Southeast Asian operating rates are expected to remain under pressure at below 70pc for PE and PP through 2028. On the trade side, regional exports are likely to decline further, particularly for PP, as China continues to move towards self‑sufficiency. China’s PP exports have increased with record high volumes and ongoing capacity expansions suggest export volumes will remain elevated over the coming years, further weighing on regional balances.

Relief Measures and Strategic Responses

Many countries are starting to take action to face these challenges. Producers globally are increasingly taking steps to address these challenges. Rationalisation efforts have already begun, with Europe leading the initial wave over the past two years. Approximately 780,000t of PE and 600,000t of PP capacity have been rationalised in Europe, driven by persistently high production costs and weak demand.

Northeast Asia will also see rationalisations in China, South Korea and Japan, following recently announced plans to rationalise old or small-scale crackers. China’s Ministry of Industry and Information Technology is conducting an assessment of petrochemical facilities that have reached their designed service lives or have been in operation for over 20 years. In South Korea, authorities have outlined plans to rationalise 2.7mn–3.7mn t, equivalent to up to 25pc of total cracker capacity. Japanese producers have announced tentative cracker closure plans for the 2027–30 period.

Beyond capacity rationalisation, producers are investing in greater operational flexibility, particularly through upstream feedstock diversification. Vietnam’s Long Son Petrochemical, for example, has announced an ethane enhancement project scheduled for completion by 2027, aimed at improving cracker economics.

Overall, the polyolefin industry is navigating through an era of weak demand and volatile macroeconomic conditions. Continuous capacity expansion and shifting trade flows are expected to intensify margin pressure and competition. While rationalisation and feedstock flexibility can provide partial relief, smaller and highercost producers remain increasingly vulnerable and risk being pushed out of an already saturated market. For southeast Asia, the challenge is to balance growth potential with structural vulnerabilities in a global environment defined by oversupply and sustainability pressures.

Author name: Elizabeth Zhang (张心怡), Analyst, Chemicals