It has been a challenging year for the global recycling industry, and the petrochemical industry as a whole, with squeezed margins, often slow demand and geopolitical uncertainty. And in amongst the generally pessimistic outlook, a variety of issues dominated the headlines nationally, regionally and globally. Our global team of reporters have highlighted some of the most noteworthy events affecting their local patch during the past 12 months.

Weak business environment hits recycling capacity

Europe's recycling industry remained under pressure this year, with market participants and representatives appealing for regulatory support to mitigate challenges including high energy costs and competition from cheap virgin polymers.

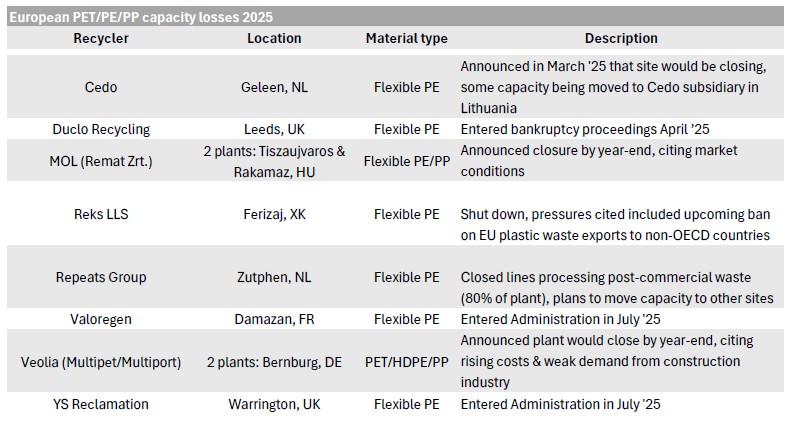

Just among mechanical PET and polyolefin recyclers, Argus counted about 250,000 t/yr of capacity losses in 2025, including the complete shutdown of nine dedicated PET/PE/PP plants, albeit with expectation that some of this capacity will be rearranged — with machines moved to other sites — rather than lost.

In addition to costing Europe existing capacity, the weak business environment is also reducing investment in new capacity to develop the region's recycling infrastructure. Polyolefin producers LyondellBasell and Borealis have paused plans to invest in new recycling capacity. Borealis told Argus in June that it would not be "pouring money into new capex" in the current economy, while LyondellBasell paused its plans for a European recycling hub and decided to delay final investment in a US pyrolysis plant until conditions improve.

Capacity closures have impacted buyers, not necessarily in tightening overall availability of material, but in forcing them to identify and qualify alternative suppliers. The EU Circular Economy Act — scheduled for 2026 — which aims to increase supply and stimulate demand for high-quality recyclates, will be closely watched to see how it can reverse the trend, whose effect will be magnified as the decade progresses and Packaging and Packaging Plastic Waste Regulation targets come into view.

SUPD support for rPET underwhelming

Recyclers had hoped that the Single-Use Plastics Directive's (SUPD) recycled content targets and collection improvement measures would buoy rPET demand and improve the quantity and quality of feedstocks in 2025. But the directive had the impact many had anticipated, and the year as a whole was much more challenging than originally expected.

Firstly, on demand, many EU member states were already close on average to the minimum recycled content requirements of 25pc in 2025, while some companies had already been going over this level under voluntary commitments. And a lack of enforcement of the targets, or clarity on the implications for member states not meeting the requirements, left many market participants requesting definitive decisions from the European Commission.

Also, falling virgin PET (vPET) prices raised the premiums for rPET over vPET, and eroded voluntary usage of recycled content in the bottle industry and particularly other applications. At one point in May, rPET flake cost €375/t more than vPET, and it is €135/t more expensive in December even narrowing significantly. For food-grade pellets, the premium over vPET peaked at €700/t and remains at €585/t at the time of writing.

At these levels, even individual countries' plastic taxes on virgin plastics — such as Spain at €450/t and the UK at just over £220/t — have been insufficient to support rPET usage, so recyclers have noticed customers switching to vPET. And, where they have had to lower sales prices to compete with vPET — and rPET imports — they have not seen similar reductions in bale prices, leading to a squeeze on their margins particularly when combined with elevated energy prices and fixed costs compared with other regions.

China joins the pyrolysis party

China's plastic waste pyrolysis industry has grown rapidly over the past year because of a growing market focus on sustainable development.

Commissioning is underway at two major plants and a third is scheduled for completion by the end of 2025, with more projects announced for the coming years even as technical hurdles remain.

Dongyue Chemical, backed by Shandong Huicheng Environmental Protection, completed China's largest 200,000 t/yr unit in Jieyang, Guangdong province, in the second quarter, but the plant struggled with sustained operations. It was shut down for upgrades, including hydrogenation and chlorine removal systems, and is expected to restart in January 2026. Despite these setbacks, Huicheng plans to build 5.4mn t/yr of capacity nationwide, with 3mn t/yr in Jieyang, Guangdong province, 1.8mn t/yr in Yueyang, Hunan province — in relation to which it signed three investment agreements with the municipal government of Yueyang city this week — and 600,000 t/yr in Heze, Shandong province.

Separately, a 30,000 t/yr unit in Weifang, Shandong province, co-developed by Green Harvest Energy and Sinoma, began trial runs in August; its full 60,000 t/yr capacity is planned in phases. Green Harvest also formed a joint venture for a project in Jilin province and plans facilities in Fujian and Jiangsu provinces, and Saudi Arabia.

As with new pyrolysis installations globally, overcoming technical challenges such as chlorine removal, impurity control, and inconsistent feedstock because of PVC contamination will be key to ensuring the sector’s long-term success. Such issues can undermine product quality, cause frequent shutdowns, and increases operating costs through higher energy use, catalyst consumption, and maintenance. But ambitious expansions signal strong interest.

UK PRN volatility rears head again

The second half of 2025 saw significant volatility in UK PRN prices, which sent bale markets repeatedly into disarray and made life difficult recyclers and – particularly – their feedstock purchasing managers.

The value of plastic packaging waste to UK recyclers depends on the value of the material itself and the value of the PRN that can be generated from it, and PRN price volatility can lead to wide bid-offer spreads for bales as buyers and sellers differ in the views of how to account for sharp rises and falls. And, with new rules governing PRN registration and accreditation from next year — with concerns already emerging about delays — the potential for further volatility in the early part of the year remains high.

This year's price increases have typically followed the monthly data releases that show PRN generation for the year-to-date, which have consistently indicated a small shortfall compared with the total annual obligation. But higher prices never seemed to last, with buyers seemingly withdrawing from the market again once they felt any individual shortfalls on their side were covered.

In addition to complicating things for UK recyclers, fluctuating PRN prices may come to the attention of recyclers in mainland Europe and elsewhere through exports. Exporters generate a PERN – which has equal value – for every tonne of packaging waste they export, meaning that higher PRN's make exports more attractive, and leading to the common complaint that PRNs, which are designed to support the UK recycling industry, in fact hold more benefit for exporters and their overseas customers.

SEA tightens plastic packaging rules

Southeast Asia has stepped up efforts to curb plastic pollution and improve consumer safety, with sweeping regulatory changes introduced in 2025.

Malaysia has taken a hard line on plastic waste imports, enforcing stricter controls under the amended Customs (Prohibition of Imports) Order which became effective on July 1. Imports of plastic scrap from non-Basel Convention countries, including the United States, are now banned. Shipments from Basel parties must meet rigorous purity standards, undergo pre-shipment inspections, and secure approval from SIRIM Berhad, Malaysia's technology standards body.

Elsewhere, Indonesia rolled out the SNI 8218:2024 standard for paper and cardboard in food packaging on July 24, complementing broader food-contact material rules notified to the WTO.

Singapore passed its Food Safety and Security Bill, granting regulators powers to ban hazardous substances, enforce recalls, and mandate Extended Producer Responsibility (EPR) reporting for packaging starting March 2025.

These measures signalled a regional shift toward stronger packaging standards, and greater accountability for producers. By combining import restrictions, material safety requirements, and EPR frameworks, Southeast Asian nations aim to reduce waste and accelerate progress toward a circular economy.

Lack of policy shift concerns US recyclers

The recycling industry entered 2025 pushing for stronger mandates and incentives to boost demand for post-consumer recycled (PCR) content. But, while pre-existing legislation, such as EPR schemes and recycled content mandates in a handful of states has continued, further development in regulations that recyclers believe are necessary to support their industry has not been forthcoming. And the incoming federal government's lack of focus on sustainability regulations leaves recyclers pessimistic whether unilateral measures may be on the horizon.

Volatility in HDPE natural prices in the first half of the year demonstrated how the market is vulnerable without widescale recycled-content requirements or enforcement. HDPE natural bales began the year at 70¢/lb and rose as high as 105¢/lb before falling to 47.50¢/lb by July. The initial price increase was driven by tightness in the market, partly linked to low collection rates in many states. Then, when prices became unpalatable for downstream buyers, at the same time as collection rates increased seasonally in the states with more recycling infrastructure, the pull-back in demand and subsequent price collapse was dramatic.

By December, HDPE bale prices increased slightly as supply tightened, but overall sentiment remains cautious. The lack of federal action and uncertainty around future legislation has slowed investment in recycling infrastructure. And there is still a large part of the recycling market – for HDPE, PP and PET - where buyers typically use recyclates to save money, putting recyclers in direct competition with low-cost virgin alternative. This was evident in the decline in HDPE coloured bales during the year, as prices fell to 3.75¢/lb by December, having started the year at 10¢/lb.