The switch from summer to winter-grade gasoline at the end of September saw European prices and margins cool as more expensive summer material gave way for the cheaper winter grade. But this year the seasonal spread — the difference between summer and winter grades — was much wider than last year.

Eurobob non-oxy premiums to Dated crude were $10.29/bl on 28 September — the first day of winter-only material — down from $19.34/bl on 22 September, the final day of summer-only gasoline. Oxy premiums fell to $10.83/bl from $21.14/bl over the same period.

Such a pronounced drop is rare. For comparison, the summer to winter transition last year led to a drop in premiums to crude of just $2.66/bl for non-oxy and $2.45/bl for oxy grades, respectively. In the 2019-21 summer to winter transitions the premium averaged a drop of just 10¢/bl for non-oxy and a $1.02/bl fall for oxy gasoline.

Summer-grade gasoline margins have been particularly high this year — rising to around $33/bl in late July and again in late August — with firm demand in northwest Europe and a steady draw from the US, which clashed with curbed refinery runs and outages in Europe. While lower than the highs reached in June 2022, when geopolitical turbulence and pent-up demand from Covid-lockdowns saw margins climb to more than $55/bl, the strength in gasoline margins extended well into September, which did not happen last year.

It is possible that a demand dip in August saw refiners switch to production of winter-grade gasoline. And traders noted that stockbuilds through late August and into September in the Amsterdam-Rotterdam-Antwerp hub were most likely winter specification. The tightness of summer relative to winter may have accentuated the seasonal spread this year.

Another factor contributing to wider seasonal spreads may be the cost of blending. The price was high for octane-enhancing components this summer, which particularly affected summer grades that have a stricter evaporability specification. For oxy-grade in particular, oxygenates like MTBE were also expensive. MTBE values climbed, with a high gasoline-naphtha spread encouraging summer blending, while more recently outages have curtailed supplies.

The high MTBE component cost has been — and continues to be — a primary factor in oxy pricing above non-oxy for large parts of the summer. Oxy gasoline averaged an $11.62/t discount to non-oxy in the summer of 2022 but this year that flipped, with oxy averaging an 81¢/t premium to non-oxy over the same period, peaking at a $31.75/t premium to non-oxy on 22 August. The high cost of the MTBE component may well have been a contributing factor to the greater seasonal spread on oxy gasoline.

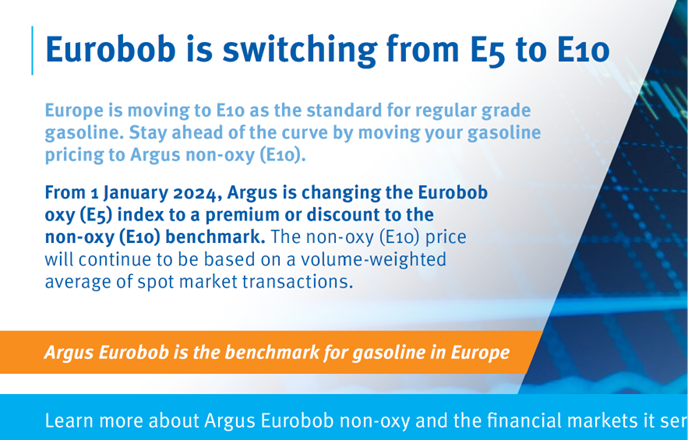

Looking ahead, with markets in Europe switching to winter grade, refiners and blenders could see some relief in wide premiums for key winter components such as butane. Butane makes up approximately 10pc of winter blends, compared with 5pc of summer blends, with higher 90kPa RVP limits for winter grades allowing for more volatile and typically cheaper components. Non-oxy barges averaged a $369.67/t premium to northwest Europe butane cargoes in September, compared with $237.54/t over the same period last year. If this premium is maintained, blender and refiners could benefit from slightly improved blending economics. Callout box at end of post: Stay on top of Argus Eurobob non-oxy (E10) gasoline barge trade

Author Jonah Sweeney

Stay on top of Argus Eurobob non-oxy (E10) gasoline barge trade