Strong renewable energy output and a lack of coal-to-gas fuel switching pushed German gas-fired power generation to the lowest level for April since at least 2011, with the trend of under-pressure power sector gas burn likely to prevail for at least the remainder of this quarter.

Outright gas-fired power generation is on track to hover around the previous decade-low reached in summer 2015, but gas burn is expected to again play a role at the margin of the German merit order next month.

Average output from renewable sources, including biomass, hydro, wind and solar, reached 0.74 TWh/day in April to meet a 48.5pc share of domestic power consumption — the highest share for any month on record — preliminary data from German research institute Fraunhofer ISE show. Thermal power generation at 0.68 TWh/day which was at the lowest level for any month since at least 2011, and within the conventional power generation mix, gas burn was under particular pressure. Higher plant availability compared with April 2017 increased the share of nuclear supply in the thermal generation mix by around 4.6 percentage points year on year to 23.2pc and of lignite-fired generation by 2.8 percentage points to 47pc. The share of power sector coal burn in the thermal generation mix was largely unchanged on the year at 22.4pc in April, despite a 16pc decline in outright production to just 0.17 TWh/day, the lowest level for the month of April in at least seven years. Power sector gas burn also fell to a seven-year low for April and by 53pc on the year to 0.5 TWh/day, with its share in the thermal power generation mix falling by 6.5 percentage points compared with the same month last year to 7.3pc.

Low gas stocks at the start of April have boosted injection demand across much of northwest Europe, pulling NCG near-curve prices above the fuel-switching price — the range at which gas-fired power plants would competitive with German coal-fired units at various efficiencies. Gas burn last month is likely to have come, by and large, from combined heat and power (CHP) plants running at minimum load to supply industrial process steam, residual heating demand during periods of unseasonably low temperatures for parts of April and hot water. Gas plants coming on line to meet demand as the marginal unit was limited to only a few hours and a few days given the strong penetration of renewable energy in April and because of the disadvantage of gas plants over coal-fired units to free up gas supply to add to storage.

The trend has continued so far this month. Combined renewable energy output has been at an average of 0.74 TWh/day on 1-9 May, so far exceeding the all-time high set in April. Nuclear power generation has been stable so far this month compared with April while lignite generation has slipped just slightly lower, leaving hard coal and gas-fired plants to bear the brunt of the further squeeze on thermal generation. Coal-fired output fell to a daily average of 0.14 TWh/day while power sector gas burn was at 0.04 TWh/day. The latter matched the decade low first recorded in June 2015 and again in August that year when day-ahead clean spark spreads were deeply negative. Several factors which have pressured coal-fired power generation and gas burn in particular in April and so far this May remain at play for the remainder of this quarter, but prevailing forward prices suggests that commercially driven gas-fired generation, while remaining under sustained pressure compared with summer 2016-17, could at least tick higher compared with recent weeks.

Rising hydro power generation has been a key driver of the record-high renewable power generation recorded in April and so far this month. German daily average hydro output, including from plants in Austria feeding into the German grid, stood at 0.11 TWh/day on 1-9 May, a new all-time high. Above-average snow fall in the 2017-18 winter combined with the onset of snowmelt pulled hydro output to a fresh high, and this is highlighted in available Swiss snowpack data. Snow depth near Montana, in the Swiss canton of Valais, stood at 418cm on 31 March, compared with a long-term average for that time of year of 279cm, according to data from the SFL institute for snow and avalanche research show. As of yesterday, snow depth stood at 291cm as snowmelt narrowed the surplus to the seasonal norm to 61cm . Snowmelt so far has encouraged stronger run-of-river generation which is uncontrolled beyond shutting damns to avoid flooding and so is unresponsive to power market price signals. While the above-average snow pack in Switzerland and in other parts of central west Europe is likely to continue to support hydro power generation throughout at least the remainder of this quarter, generation could fall back behind the high levels recorded in April and May next month with less water being fed into rivers as snowpack falls.

On the demand side, power consumption is typically higher month on month in June as several public holidays in Germany and in neighbouring countries weighs on demand in May.

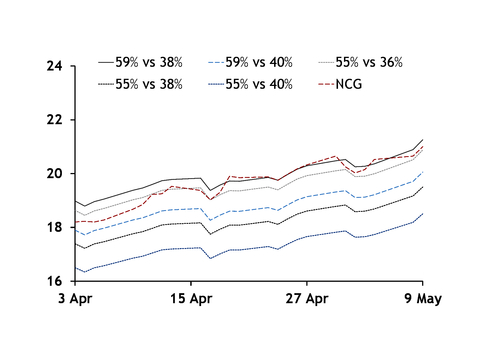

Combined nuclear plant availability in Germany, France, Switzerland and Belgium is scheduled to average 63.2GW in June compared with the 59.6GW scheduled for May and above actual plant availability of 55.5GW in June 2017. But in Germany, nuclear plant availability is scheduled to be steady month on month at 7.6GW in June compared with 7.4GW this month and below actual nuclear plant availability of 9.4GW in June last year. On days with lower wind and solar power generation and in light of the potentially lower run-of-river hydro and higher power consumption levels in June compared with recent weeks, the German marginal unit could then be more often pushed to gas burning territory. The correlation between the German May base-load contract and movements for corresponding API 2 coal swaps and NCG gas hub prices was negative throughout April. But there is a strong correlation between the June base-load power contract and corresponding API2 coal and NCG prices on 1-9 May as the market prices in higher probability of Germany being pushed to coal and gas burn at the margin next month. Competition for the role of as the marginal plant could be steep between old coal and efficient gas units in June on low renewable days, as the NCG gas hub contract held above the fuel-switch price at which a 59pc-efficient gas unit can compete with a 38pc-efficient coal plant. And modern gas units tend to be more flexible than ageing coal units which could provide an opportunity for gas-fired plant operators to optimise their plants in the intra-day market.

The latter was highlighted in continuous intra-day trading yesterday. The German-Austrian intra-day product delivering at 08:00 CEST (06:00 GMT) trades as high as €399.80/MWh and expired at a weighted average of €97.24/MWh compared with a day-ahead settlement at €42.86/MWh for that hour. Gas-fired power generation was 2.4GW in hour 8, compared with planned output of 2.1GW. An unplanned outage at the 726MW Wilhelmshaven 1 coal plant contributed to a tighter than expected power system yesterday morning. Coal-fired output was 5.3GW in hour 8, compared with planned production of 6.6GW as highly efficient gas rather than medium-efficient coal plant ramped up to smooth out the system deficit.