Infrastructure constraints are weighing on crude prices in the Permian basin and costs are rising, independent oil firms in the region say.

Pipeline, processing and gathering capacity has failed to keep pace with rapid output growth in the Permian basin, which stretches across west Texas and east New Mexico. And costs are rising as the oil service industry seeks to restore some of the tens of thousands of jobs cut in 2015-16.

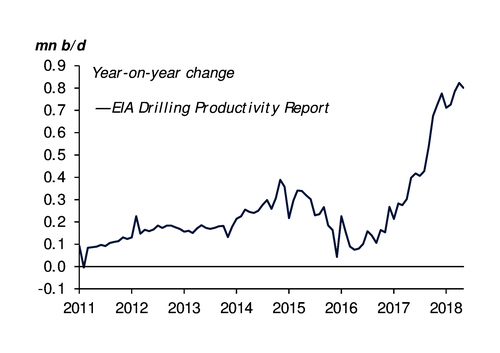

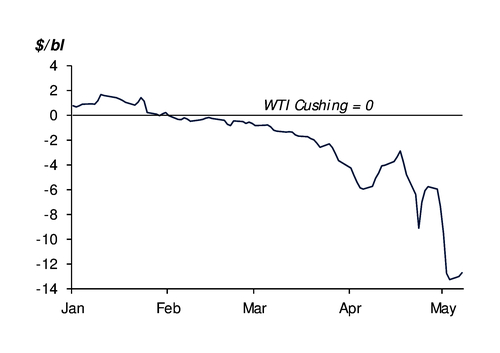

US output is expected to rise by nearly 1.4mn b/d this year and a further 1.1mn b/d next year, with much of the growth coming from the Permian, the EIA says. But the higher production is outstripping pipeline takeaway capacity, pushing WTI priced at the Midland hub in Texas to a discount of around $13/bl to WTI Cushing. And major new pipelines to move the rising supply are not expected to come on stream until next year.

A lack of sufficient pipeline capacity is expected to remain a constraining factor until the latter part of next year, which will keep Permian prices under pressure, says Pioneer Natural Resources chief executive Tim Dove. Pioneer has transport contracts in place to move 160,000 b/d of crude, or about 95pc of its output in the region, to the Gulf coast. It plans to secure firm agreements to move more than 90pc of its production as its output increases.

Apache chief executive John Christmann says Permian operators face risks from lower prices and reduced offtake because of the pipeline constraints. The company plans to sign firm sales and offtake contracts to minimise the risks. And Permian producer Anadarko has secured long-term transport capacity commitments covering more than half of its expected oil production this year and nearly all of its expected production in 2019.

Cost pressures

Rising costs are an issue. Pioneer will boost its 2018 capital expenditure (capex) from guidance of $2.9bn because of rig additions later this year to boost production, a wider rollout of a new well completion design that requires more upfront spending and higher costs. "We are drilling the most productive wells in the basin that are low cost and generate strong cash operating margins and high rates of return," Dove says.

Even so, production costs in the first quarter rose to $10.30/bl of oil equivalent (boe) from $9.09/boe in the fourth quarter. The rise was also the result of higher production taxes resulting from increased oil prices. The second-quarter cost forecast is $10-12/boe.

Marathon Oil and ConocoPhillips — which have large operations in other basins besides the Permian — cite rising costs as a concern. But the increases are largely within expectations and technology improvements will help offset any further gains. "We feel very comfortable at this stage that we have that fully accounted for in our budget," Marathon chief executive Lee Tillman says.

Producers in other shale oil regions are benefiting from improved pipeline capacity. Continental Resources is enjoying higher crude prices in the Bakken formation in North Dakota. Bakken crude discounts to WTI Cushing averaged around $4.30/bl in the first quarter, much narrower than the $8.10/bl discounts of a year earlier. This is one reason behind it raising output in the basin by close to 50pc to 160,000 boe/d in the first quarter from a year earlier.

EOG Resources, the largest oil producer in the Eagle Ford in Texas, is able to steadily increase production because the basin has plentiful infrastructure. Its costs in the region fell to $4.5mn/well last year from $7.2mn/well in 2012. The target is to reduce that to $4.3mn/well.

"This basin continues to deliver consistently outstanding results," chief executive Bill Thomas says.