A recent amendment to Cheniere Energy's long-term contract with its marketing subsidiary could make it more difficult to track US spot LNG transactions with government data.

In August Cheniere removed an upper limit that its Cheniere Marketing subsidiary can sell under a 20-year contract of 2mn t/yr, equivalent to 276mn cf/d (2.85bn m³/yr) of gas. This would mean that all of Cheniere's Sabine Pass LNG production in excess of long-term deals to third parties can be provided to its marketing subsidiary for resale without any of it being reported as spot transactions.

The US Department of Energy (DOE) requires public disclosure of some details of LNG exports, including whether they are sold under one-time spot transactions, short-term contracts of up to two years or long-term contracts. But that data is only for transactions between the LNG producers and contractual offtakers — so it often does not reflect how the offtakers market US LNG globally. Long-term customers often resell their Sabine Pass cargoes under spot or short-term deals.

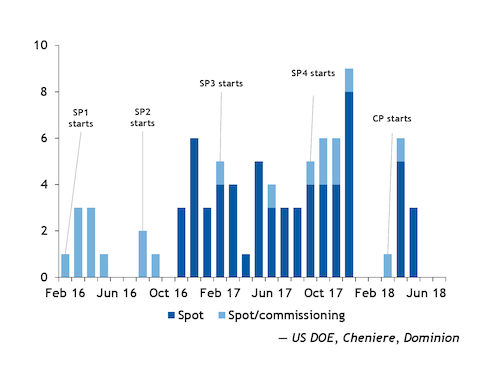

The US is expected to become a leading supplier of spot and short-term LNG in an increasingly liquid global market, but the vast majority of the country's LNG exports to date have been classified by DOE under long-term contracts. Cheniere has reported 82 spot deals out of the 449 cargoes exported out of its Sabine Pass LNG terminal in Louisiana since it came on line in February 2016 through July 2018 — the last month for which DOE figures are available.

Cheniere charges its long-term Sabine Pass customers liquefaction fees ranging from $2.25-$3/mm Btu for all their contracted capacity, whether they take LNG or not. If those customers want the supply they pay an additional fee of 115pc of the Nymex final settlement for the month in which a cargo is loaded.

Cheniere reports free-on-board (fob) prices to the DOE for its long-term exports based on those fees, so those figures do not provide insight on US LNG spot prices. But the fob prices that Cheniere reports for its spot or short-term deals provide some insight, as those sales are likely based on global supply-and-demand dynamics at a given time.

Cheniere declined to comment on its spot transactions.

According to the DOE data, 19 of the Sabine Pass spot exports were test cargoes for the first four liquefaction trains at the facility. Many of the remaining spot cargoes were available because of the lag between a train's being commissioned and the start of long-term offtake contracts. There were 26 spot or commissioning cargoes sold in September-December 2017 following the start of Sabine Pass train 4. Some of these may have been in advance of Indian firm Gail's long-term offtake for 3.5mn t/yr, which started in March (see table).

Some of the reported spot cargoes to date may have resulted from Cheniere Marketing's take exceeding its previous long-term contractual limit of 2mn t/yr. There was a high number of spot cargoes reported in the fourth quarter last year as strong northeast winter Asian LNG demand, particularly from China, drove global spot prices.

Selling around seven cargoes a month through Cheniere Marketing boosted Cheniere's revenues in the first quarter, the parent company said. This number equated to 30pc of the plant's output, but Cheniere did not report any spot transactions in the first quarter to the DOE.

Cheniere Marketing could take more LNG next year as output starts from Sabine Pass train 5 as well as the first two trains starts at Corpus Christi, Texas, where Cheniere Marketing has up to 3.5mn t/yr of offtake under a 20-year contract. Cheniere has sold to third parties 80-90pc of the expected output from five Sabine Pass trains and three Corpus Christi trains, which will provide about 5mn t/yr to Cheniere Marketing.

Cheniere Marketing plans to sell its portfolio under a combination of long-term, short-term and spot deals. The marketing arm has already committed more than half of its expected supply to long-customers, in addition to the long-term deals the parent company previously signed. Cheniere Marketing earlier this month signed a 15-year deal with Swiss trading firm Vitol for around 700,000t/yr. In August it signed a 25-year deal with Taiwan's CPC for 2mn t/yr and in January it signed a 15-year deal with Swiss trader Trafigura for 1mn t/yr.

The only other major US LNG export terminal currently on line, Dominion's Cove Point facility in Maryland, also may report few, if any, spot exports.

Cove Point listed two spot exports of test cargoes in March and April. The remaining 21 exports from Cove Point through July were all listed as long-term deals to customers Gail and Sumitomo. Dominion declined to comment on whether it plans to market any spot cargoes on its own. Cheniere has more incentive to market LNG as it procures gas and pipeline transportation for its customers. Cove Point customers must buy gas and pipeline capacity themselves.