Around 2GW or more of grid-connected batteries will be deployed five years from now, and 4GW or more 10 years from now, driven by growing volatility in balancing and wholesale markets, according to Aurora Energy Research.

As intermittent renewable sources such as wind and solar enjoy a larger share of the UK generation mix, price volatility will increase, creating lucrative openings for batteries that are able to store energy when power prices are low and release it when prices are higher.

Until recently, one of the most attractive revenue sources for storage technologies had been frequency services, such as firm frequency response (FFR) and enhanced frequency response (EFR), where battery operators earn money through the awarding of long-term contracts that oblige them to be ready to turn on and off at short notice to help maintain the grid's frequency near 50Hz.

But as more batteries crowd in, prices in the frequency response markets are falling, and battery operators are turning to the wholesale and balancing markets instead.

"Battery capacity is growing not because of frequency services alone, but [because of] the larger application in the wholesale market and balancing market, which are much larger in size and therefore have a lot of space for batteries," Aurora's head of flexibility and battery storage, Felix Chow-Kambitsch, told Argus ahead of Aurora's battery storage conference in London today.

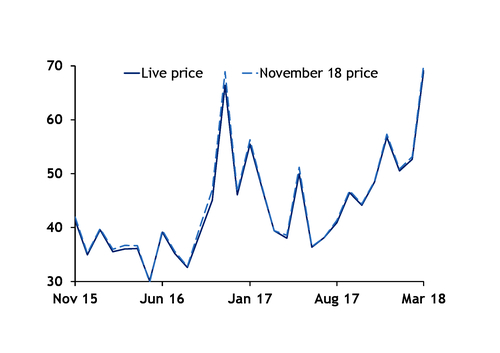

With increasing price volatility as wind and solar sources claim a larger share of the mix, batteries will help to smooth out power generation. The standard deviation of balancing market prices so far this year is £32.17/MWh, only slightly higher than 2017's £31.16/MWh. But new reforms could soon boost volatility further. Balancing market prices have also increased outright, increasing the market's attractiveness.

This will also allow investors a way to hedge exposure against uncertainties, increasing the sector's attractiveness. Aurora research released today suggests an investment opportunity "in the region of" £6bn between now and 2030 for flexible assets that are able to leverage this growing price volatility.

Batteries currently meet over half their required margin by operating in the wholesale and balancing markets. That is poised to grow in the future, Chow-Kambitsch said.

Batteries scaling up

Some 300-400MW in battery storage is deployed on the UK grid, with more due on line next year, including 50MW from the UK's Pivot Power. According to Aurora's modeling, that figure will climb to at least 2GW in five years and to at least 4GW in 10 years, Chow-Kambitsch said. In all, around 13GW of new flexible and distributed generation assets will be deployed on the grid by 2030, according to Aurora modeling unveiled today. The latter figure includes both batteries and assets such as gas-reciprocating engines.

"Gas engines and renewables provide a natural hedge to one another, lowering the volatility of investor returns on a year-to-year basis," Chow-Kambitsch notes in the research released today.

The investment outlook for battery storage has changed radically in the last 12 months. Besides the growing saturation of the frequency response markets, de-rating factors for batteries were reduced in December last year, undermining batteries' ability to compete in capacity markets and shrinking a revenue stream. In addition, Triad payments to embedded generators have fallen.

Those and other changes are pushing battery operators into new spaces. For example, reforms by regulator Ofgem will soon allow the participation of small-scale distributed generation in the UK-wide balancing mechanism, opening up this market to a number of new participants such as energy aggregators like the UK's Limejump.