Baghdad's production targets have been continually postponed and lowered in recent years and capacity increases remain slow

Iraq's oil ministry has ambitious plans to increase crude capacity and production over the short and longer term. But long-standing contractual and capacity issues continue to stand in the way of its targets as a new government aims to put its stamp on the country's vital oil sector.

Baghdad hopes that reviving Iraqi national oil company Inoc will help to centralise the implementation of capacity expansion plans. The acting cabinet has appointed oil minister Jabbar al-Luaibi to head Inoc, which has yet to be activated. But the laws governing Inoc will need to be established by the next cabinet, which is currently being formed. Al-Luaibi's replacement as oil minister has yet to be decided.

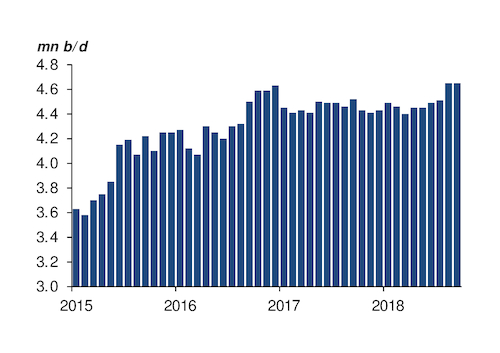

Uncertainty over Inoc's role comes as the country reappraises its crude capacity targets. Iraq originally targeted total production capacity of 5mn b/d by the end of last year. The target was then pushed back until the end of 2018, but capacity increases remain slow. In recent years, Iraq's output targets have been repeatedly postponed and lowered as Baghdad finds itself unable to pay the foreign companies operating and developing its largest fields.

These are largely overseen by state-owned Basrah Oil (BOC). The firm expects Basrah's crude production alone to reach 5mn b/d by 2025, BOC director-general Ihsan Ismael said at the CWC Basrah Oil and Gas conference in Istanbul on 9 October. Argus estimates Basrah's current production to be around 3.25mn b/d.

A backlog of projects under discussion with little progress continues to hold back capacity expansion. The oil ministry has yet to finalise production plateaus with foreign oil firms operating in the region. Ismael says they could now be agreed in the first quarter of 2019. BP's Iraq country manager Zaid Elyaseri says plateau targets are still being discussed for the country's largest field, Rumaila, but are focusing in on 2.1mn b/d, up from a previously reduced 1.8mn b/d.

BP is injecting a record 1.4mn b/d of water from its Qarmat Ali plant to maintain production of around 1.5mn b/d at Rumaila. This is up from 900,000 b/d of water injection this time last year, as BP completed a new water pipeline in the first quarter of 2018. But the plant requires a new 2mn b/d water pipeline to increase output at Rumaila — discussions with the ministry and BOC continue.

Back in the CSSP

Iraq's long-delayed Common Seawater Supply Project (CSSP), which would desalinate seawater for injection, is key to maintaining production at other mature fields in the south. Without it, Iraq will struggle to expand its southern production capacity. ExxonMobil was previously in talks with the oil ministry to invest in the CSSP, alongside the multi-billion dollar South Integrated project, but pulled out of the former while continuing to negotiate the latter.

Ismael says the oil ministry aims to award CSSP separately, with one unnamed bidder. The project could still be linked with the south integrated development, pending agreement with ExxonMobil, he says. The first stage of CSSP will treat 5mn b/d of seawater, with the possibility of increasing this to 7.5mn b/d. The project will cost less than an original estimate of $4bn, Ismael says.

Iraq's limited export capacity remains an issue as the country targets higher production. Southern exports reached an all-time high of 3.61mn b/d in August, Argus estimates. The oil ministry maintains its nameplate export capacity is around 4.6mn b/d, with operational capacity at 3.7mn b/d, excluding the Khor al-Amaya terminal, which is undergoing maintenance and accounts for a further 300,000 b/d. Planned offshore pipelines from the south could add a further 3mn b/d of export capacity by 2023, Ismael says.