About $8bn of the extra $9.6bn of capex in Petrobras' 2019-23 business plan will go towards exploration and production

Brazil's state-controlled Petrobras has boosted upstream capital expenditure (capex) in its $84.1bn investment plan for 2019-23, although the production target for the end of the five-year period remains flat.

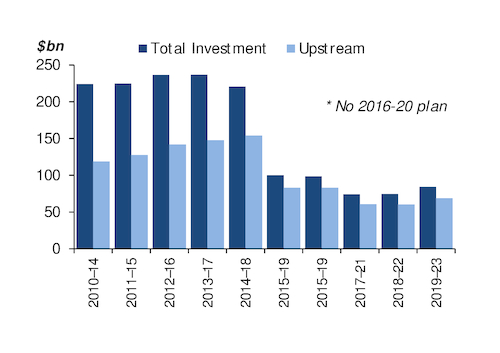

The plan represents a 13pc increase in spending from the previous $74.5bn plan for 2018-22 — the biggest year-on-year gain since 2011. Around $8bn of the additional $9.6bn in spending will be directed towards exploration and production. Maintaining or expanding the investment goals set out in the business plan will be a task for incoming chief executive Roberto Castello Branco, the University of Chicago-trained professor appointed by president-elect Jair Bolsonaro to take the reins at the firm on 1 January.

Upstream spending is projected at just under $69bn over the new five-year period, with pre-salt development accounting for around $27bn, a slight increase compared with the previous plan. The Buzios pre-salt field — one of the projects in the Santos basin cluster known as the transfer of rights (TOR) region — leads planned pre-salt spending with $9bn, followed by Mero — the first commercial discovery in the Libra project — with $3.5bn.

Post-salt development spending increases to just over $21.2bn compared with a previous $19.5bn. Of this,Petrobras will spend around $20.5bn to revitalise the mature Campos basin, where natural decline has cut output to its lowest since 2001. And exploration spending rises the most proportionally, up by over 60pc to $10.8bn. Most of that will be spent on exploring dozens of pre and post-salt assets the company picked up in recent upstream licensing rounds.

Domestic oil production is forecast to climb to 2.3mn b/d in 2019, a 9.5pc rise from Petrobras' 2.1mn b/d target for this year. That increase takes into account a planned divestment of producing assets accounting for 100,000 b/d, although the company does not disclose if that comes from domestic or foreign fields.

Petrobras' total output this year is expected to inch up to 2.8mn b/d of oil equivalent (boe/d) in 2019 from 2.7mn boe/d in 2018. And the firm says oil production should grow at an average rate of 5pc/yr over the next five years. Based on the 2.3mn b/d target for 2019, domestic oil flows would reach 2.875mn b/d by 2023, in line with its previous plan for 2022.

Platforms for growth

Petrobras plans to add 13 new domestic production platforms, almost all pre-salt units, by 2023. The P-76 and P-68 platforms earmarked for the Buzios and Lula fields, respectively, will only come on stream in 2019 and not this year as previously targeted. The first unit planned for the Atapu pre-salt field — a TOR asset — has been pushed to 2020 from 2019. A new unit in the Campos basin's Marlim field scheduled for 2021 is now due in 2023, and units for the Itapu field — another TOR asset — and in post-salt Sergipe planned for 2022 have been delayed to 2023.

Petrobras plans to invest $13.9bn on refining, gas and energy projects — stable from the previous plan. The firm has earmarked $1.3bn for refinery projects, mainly a pollution treatment unit and a second 115,000 b/d train at the Abreu e Lima refinery. The two projects could add around 160,000 b/dof new capacity, it says.

The refinery plans also include ultra-low sulphur diesel projects, which could add another 98,000 b/d in capacity. Petrobras still aims to sell 60pc stakes in four refineries, shrinking its share of the domestic refining market to around 60pc from 99pc. This plan was blocked by Brazil's supreme court in July but is expected to advance next year. Part of the new spending plan will be financed by around $27bn in asset sales, bringing the company's divestment target in 2015-23 to around $62bn.