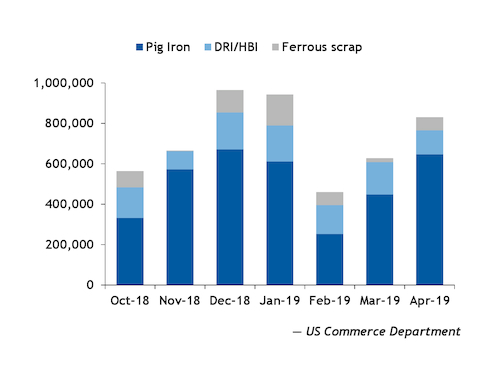

US southeast imports of ferrous scrap doubled year over year in April 2019, while pig iron imports rose against fewer HBI/DRI shipments.

Combined scrap and metallics imports rose by 55pc to 830,451t on the month, according to US Commerce Department data. Year-to-date tonnage for scrap and metallics combined fell by 5pc at 2.59mn t compared to the same period a year earlier.

Scrap

Ferrous scrap imports to southeastern US ports doubled to 64,659t versus April 2018.

Two bulk cargoes from the Netherlands and Sweden to Charleston, South Carolina, and Mobile, Alabama, respectively, made up 96pc of the intake for the month.

Year-to-date imports for ferrous scrap climbed by 62pc to 300,375t.

Metallics

Pig iron imports rose by 77pc to 647,171t in April compared to 2018 on larger tonnages from Russia, Ukraine and South Africa.

Russian imports composed 69pc of monthly pig iron shipments to the US in April at 444,780t, a 21pc increase year over year.

Ukrainian imports rose by 56pc to 120,554t compared to April 2018, while South African shipments increased by 64pc to 15,415t.

Imports from Brazil fell by 35pc to 66,396t.

New Orleans-bound pig iron increased to 515,858t from 188,891t a year ago. Tonnages shipped to Mobile went largely unchanged at 100,262t compared to April 2018.

Shipments to Charleston slipped by 42pc to 31,051t, while Wilmington, North Carolina, received no tonnage on the month.

Year-to-date pig iron imports fell by 14pc to 1.96mn t.

HBI/DRI imports ticked down by 14pc as Trinidad and Tobago shipped 118,621t versus 138,650t in the prior year. Year-to-date tonnages edged up by 5pc to 599,309t.

Combined HBI/DRI and pig iron imports rose by 52pc year over year for April. Year-to-date metallics imports dropped by 9pc to 2.29mn t.