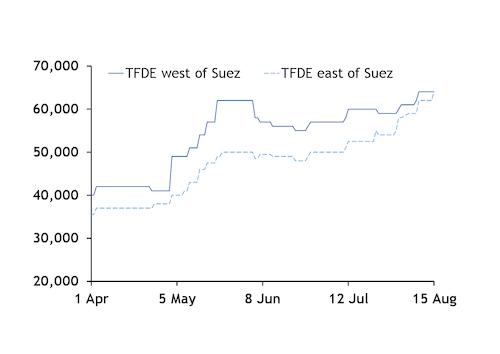

Day rates for LNG vessel spot charters have risen in recent days, with east of Suez rates moving in line with their west counterparts.

East and west of Suez day rates for tri-fuel diesel-electric (TFDE) vessels were at $64,000/d on Thursday, up from $59,000/d and $62,000/d, respectively, a week earlier.

Tightening vessel availability in the Pacific basin has pulled east of Suez TFDE rates higher in recent weeks, having been around $7,500/d lower than west of Suez rates as recently as 22 July. A number of fob tenders as well as northeast Asian delivered prices widening their premium to northwest European gas hubs may have boosted shipping demand in the Pacific basin.

But narrowing global price differentials in recent days could encourage more Atlantic-loaded uncommitted cargoes to be delivered to Europe rather than take the longer route to Asian markets in the coming weeks.

Assuming shipping costs associated with a roundtrip journey at prevailing day-rates, a US cargo loading and delivering to northwest Europe next month could achieve 9¢/mn Btu more than if shipped to northeast Asia in October.

US producers could also have more LNG to offer on the spot market from the second half of this month as the Freeport export project was close to loading its first test cargo and Elba Island had applied to start service this week. The 155,300m³ LNG Jurojin was expected to arrive empty at Freeport on Thursday.

That said, the steep contango in northeast Asian delivered prices could provide an incentive for floating storage and slow sailing using US-loaded cargoes, market participants said. The Argus northeast Asian (ANEA) des price for October was at $4.63/mn Btu on Thursday, $1/mn Btu and $1.84/mn Btu below the November and December prices, respectively.

Given US-loaded cargoes take around 30 days to be delivered to northeast Asia, firms loading a fob cargo in the US will seek to deliver to northeast Asia against at earliest the following month's des price. Slow sailing could then allow for US fob cargoes loaded in the second half of September and same period of October to be delivered in November or December.

A US offtaker loading in September and delivering to northeast Asia in October would achieve returns of $3.16/mn Btu, based on prevailing prices and day rates. But they could achieve $4.16/mn Btu if they deliver the cargo in November. The added cost of floating the cargo for a month based on prevailing day-rates and assuming a boil-off of 0.1pc per day would be 71¢/mn Btu, which could be low enough to justify delivering at a later date, although boil-off may vary depending on sailing speeds.

And taking a longer route to Asia could help shippers avoid Panama Canal costs, providing further incentive for later deliveries.

But TFDE day rates could rise to around $120,000/d by late November, market participants said. This could discourage firms that do not have vessels on long-term charter, and therefore do not consider shipping costs as sunk, from slow sailing between the US and northeast Asia.