Ammonium sulfate (amsul) imports to the US could be impeded as the US Trade Representative (USTR) considers tariffs on EU nitrogen fertilizers as a part of larger dispute involving aircraft subsidies.

The US is considering imposing tariffs of up to 100pc on EU nitrogen imports, including amsul. Substantial tariffs on amsul from the EU would further restrict offshore options for US consumers and potentially open opportunities for Canadian exports to rise.

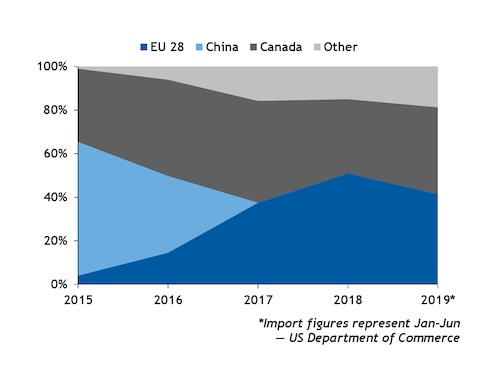

US amsul imports from the EU comprised more than 50pc of offshore volumes in 2018 and nearly 40pc during the first six months this year, according to customs data. But the EU's robust share in the US market is a recent shift in trade flow.

The US Department of Commerce implemented in 2017 a 206.72pc tariff on Chinese amsul imports following a nine-month anti-dumping investigation after growing to account for 61pc of amsul imported into the US in 2015.

EU suppliers, primarily Lanxess out of Belgium and Fibrant and OCI from the Netherlands, stepped in to fill in the gap China left in the US during the last two years. Imports meet about 30-33pc of estimated annual US consumption, indicating foreign product is still required to satisfy annual demand. But offshore options are limited for US consumers.

China is the leading exporter of amsul, shipping about 5.3mn-6.8mn t/yr between 2015-18, according to customs data. Belgium and the Netherlands — members of the EU — follow, exporting about 1.7mn-2.2mn t/yr and 725,000-2mn t/yr, respectively, during the same three-year period.

Canada could emerge as a larger amsul supplier to the US if the USTR implements high enough tariffs to lock out EU importers.

Canada has accounted for at least 34pc of US amsul imports since 2015 and could expand its market share as Nutrien leverages increased output at its Redwater, Alberta, facility.

Nutrien is converting its MAP unit at Redwater to double its amsul production capacity to 700,000 t/yr. Market participants widely anticipate the producer will utilize its bolstered output to further supply western Canada and the US Pacific Northwest in addition to the US' leading amsul consuming states. Wisconsin, Minnesota and the Dakotas are some of the leading amsul consumers in the US and best situated to receive increased rail volumes from Canada by way of the CN freight railway, potentially displacing US producers.

US producers could redirect volumes to the Midwest and southeast markets to minimize offshore requirements, or export their output.

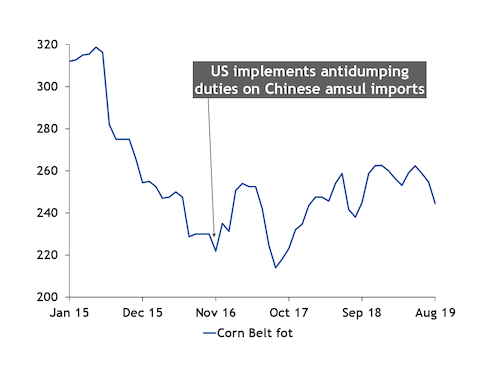

Warehouse prices in the Midwest would likely react immediately to a stark shift in offshore supplies. Average monthly spot values throughout the Corn Belt sank by nearly 30pc in 2015-16 as lower-priced Chinese imports flooded the market and forced domestic producers to compete at lower price levels. Corn Belt warehouse prices jumped by about 8pc between January and February 2017 after the US handed down anti-dumping duties on Chinese imports.

The Midwest market has incrementally recovered during the last two years as import volumes remain below 2015 levels. Another change in trade flow, especially a restriction in volumes, would heighten market firmness and potentially support a near-term price rally.