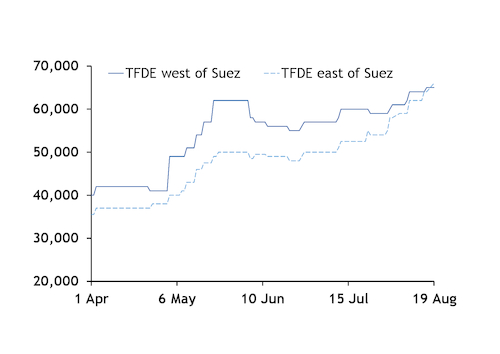

Day rates for tri-fuel diesel-electric (TFDE) LNG vessels chartered on a spot basis in the Pacific basin rose to $66,000/d on Monday, above rates for vessels fixed in the Atlantic basin.

Tightening vessel availability in the Pacific basin in recent weeks, initially driven by a spate of fob tenders in the basin, has buoyed east of Suez spot charter day rates. And shipowners are holding off fixing for the fourth quarter, eyeing a contango in forward spot charter rates, market participants said.

Stronger northeast Asian des prices for delivery in October-November may have also supported spot charter rates. The Argus northeast Asia (ANEA) October des price held a 25¢/mn Btu premium over the September contract at the Dutch TTF gas hub, when both were netted back to the US for a September loading. The steeper contango on the ANEA near-curve widened this inter-basin arbitrage for the following month to 33¢/mn Btu for an October loading.

Longer journey times from the US to northeast Asia, than to Europe or South America, would increase the tonnage demand from US liquefaction projects and the firms holding fob offtake from them.

The US' expected liquefaction capacity for the fourth quarter of 2019 is around 46mn t/yr. This would equate to around 50 loadings per month.

If northeast Asia received the same proportion of US production over the quarter as the previous year — around 44pc — this would equate to around 5.06mn t of LNG. But if the region imported in line with the fourth quarter of 2017 — around 65pc of US exports — this would rise to 7.48mn t.

Tonnage demand for 2018's proportion, based on a 50 day historical round trip from the US to northeast Asia and a 165,000m³ average vessel capacity, would be 37 LNG carriers. If the same proportion of US LNG was delivered to the region in the fourth quarter this year as the same period in 2017, tonnage demand would rise to 54 vessels.

But if demand weakens in the fourth quarter, loadings at US liquefaction facilities are unlikely to slow significantly.

Firms with offtake from US operator Cheniere's 25mn t/yr Sabine Pass and 10mn t/yr Corpus Christi facilities are required to give notice 60 days ahead of any turning down of their contracted volumes from the facilities. And Cheniere itself is unlikely to consider shutdowns, given that the firm has been heard lengthening its shipping position in recent weeks ahead of the fourth quarter, market participants said.

Weaker demand could also tighten vessel availability. If LNG demand were to weaken through the quarter, cargoes could be loaded at liquefaction facilities for delivery significantly beyond the required journey time to the respective regasification terminal. This may increase tonnage demand from offtakers or any other firm seeking to secure a spot fob cargo from the US.