Shipowner Gaslog expects increased LNG vessel availability to offset slowing liquefaction capacity growth by 2021, following a structurally tight market until 2020, echoing expectations from other shipowners earlier this year.

Gaslog expects higher LNG freight demand from increased liquefaction capacity to hold until 2021, the firm said.

But this is later than expectations given by Norway-based shipowner Flex LNG and Bermuda-based firm Teekay LNG Partners in August this year. Both firms see the slowing of liquefaction growth to weigh on spot charter rates from the second half of 2020 onwards.

Demand to support charter rates to 2021

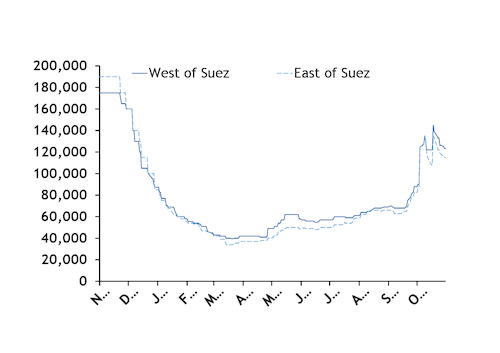

Continued high global liquefaction capacity growth is set to increase demand, and lead to a "structurally tight" freight market, supporting spot charter rates through this winter to 2021, Gaslog said.

The support means spot charter rates are unlikely to fall as far in the first quarter of 2020 as they did at the end of last winter, the firm added.

But it still wants to tie its vessels to term charters and reduce its spot market exposure, as well as increase utilisation of its vessels, Gaslog said. This may be in anticipation of lower rates as LNG export growth slows at the end of 2020.

Gaslog has five vessels operating on the spot charter market, from an operational fleet of 28 vessels. Another two vessels are under term charter, but with variable market rates.

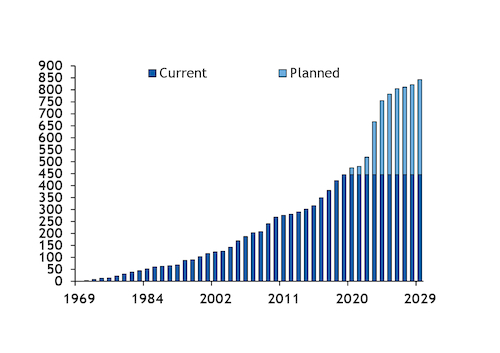

Global liquefaction growth has held quick in recent years, driven largely by increases in the US' LNG export capacity. This growth is set to hold into 2020 with the planned start-up of the second and third 5mn t/yr trains at Cameron LNG and Freeport LNG in the first half of the year.

And the 4mn t/yr Elba Island's 10 liquefaction trains — each with a capacity of 400,000 t/yr — are set to be incrementally commissioned over the year at a rate of one per month, with the first beginning production in October this year. US loadings could increase to around 70 cargoes per month by the end of winter.

The rise in US liquefaction capacity over the first 6-9 months of 2020 is set to increase demand for LNG shipping, with the geographical location of the country in relation to demand markets in Europe and Asia giving its export projects the highest demand — the number of vessels required to load each mn t of LNG — globally.

Slower liquefaction growth to weigh on freight market

Liquefaction capacity growth is likely to slow in 2021, with only the third 5mn t/yr train at Cheniere's Corpus Christi facility scheduled to be commissioned over the year, despite a continued rate of newbuild LNG carriers coming on to the water over the year, Gaslog said.

The slowdown in export growth against continued freight supply is likely to weigh on spot charter rates.

Slower liquefaction growth in 2021 is a result of limited final investment decisions being taken on LNG export projects in 2015-18, Gaslog said.

Global liquefaction capacity is not set to increase significantly again until 2023, when planned projects in the US, Russia, Qatar and Mozambique are scheduled to begin production.

A weaker LNG freight market may open the potential for mergers and acquisitions, Gaslog added, despite firms in the market historically avoiding such consolidation movements. But in contrast to previous years, new entrants to the market have different funding structures, which may encourage mergers and acquisitions by older firms, Gaslog said.

Gaslog not seeking to increase orderbook

The prospect of higher vessel availability in 2021-23 than the remainder of this year and through 2020 means Gaslog is unlikely to order any new LNG carriers for delivery in this period, the firm said.

It also noted that the industry itself does not need further increases in expected freight supply over 2021-23.

Gaslog currently has seven vessels on the orderbook, all of which are tied to long-term charter agreements. The vessels are scheduled for delivery from the second quarter of 2020 to the third quarter of 2021.

Panama FSU installation in November 2020

The 155,000m³ Gaslog Singapore will arrive at the LNG-to-power project in Panama — led by Chinese firm Sinolam — in November 2020, where it will operate as a floating storage unit (FSU).

The vessel will operate on the spot charter market until September 2020, when it is set to undergo conversion to an FSU — which will take 50-55 days, Gaslog said.

Sinolam's project was originally planned to supply local utilities from November 2020, but the facility may not be commissioned before January 2022, Panama's energy department said in April.

The Gaslog Singapore will be under a 10-year charter with the project, with an option for a five-year extension. This would cover the 15-year agreement the project signed with Shell in September 2018 for the supply of 400,000 t/yr by the firm.

But the use of the Gaslog Singapore — a dual-fuel diesel-electric (DFDE) vessel — for the generation project, which typically uses older steam turbine vessels, is not a sign the industry wants to move away from using steam turbine vessels as FSUs, Gaslog said. Instead, storage capacity of Gaslog's existing steam turbine fleet was below the project's requirements, leading it to sign a term charter for the DFDE vessel.

Gaslog is also in negotiations for the provision of steam turbine vessels to act as FSUs for a "couple" of other LNG-to-power projects, the firm said.

Cool Pool second coming unlikely

Gaslog is not looking to be "proactive" on any projects similar to the firm's previous joint venture with fellow shipowner Golar — the Cool Pool — following Gaslog's exit from the venture earlier this year.

The firm left the Cool Pool, which offered spot LNG carriers, after Golar announced it would spin off its LNG shipping business and instead focus on its LNG infrastructure business.

Gaslog had five vessels in the venture — the Chelsea, Singapore, Savannah, Skagen, Shanghai and Salem — all of which have remained on the spot charter market.

But with the firm looking to tie more of its vessels to term charter agreements, Gaslog believes a similar venture to the Cool Pool could impede this movement, as vessels would be expected to remain in the venture as open for spot charters. Gaslog has had two term charter agreements evolve from discussions for spot charters, the firm said, noting that it sees potential for more such agreements in the future.

And the firm is seeing more enquiries for term charters as spot charter rates have risen in recent weeks, Gaslog said, mirroring a similar increase in term charter demand last year as rates rose over the fourth quarter of 2018.