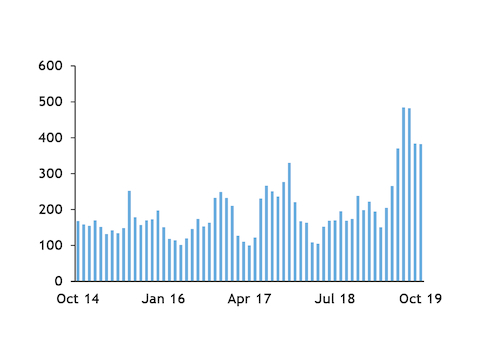

Western European power sector gas burn climbed to a recent-year record for October last month, but was not strong enough to fully offset a fall in northwest European injection demand.

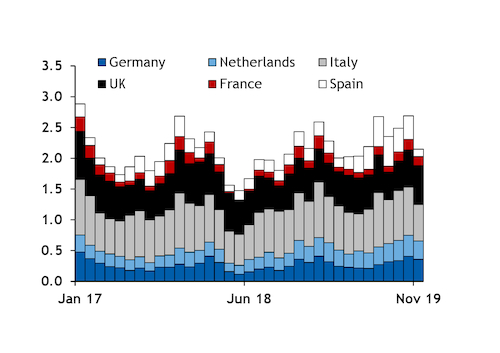

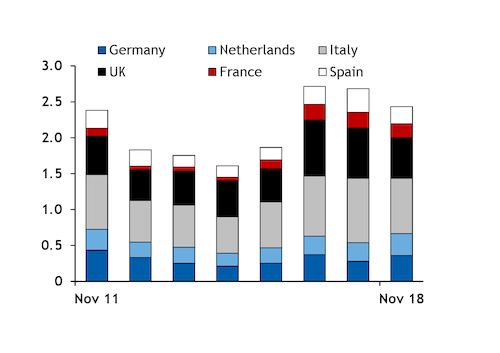

Combined power sector gas consumption in Germany, the Netherlands, France, the UK, Italy and Spain climbed to around 2.7 TWh/d in October from 2.1 GWh/d a year earlier and was the highest for the month since at least 2011. It was the strongest power sector gas burn for any month since at least the 2.9 TWh/d in January 2017 when a deep cold snap lifted power and gas demand across the continent and renewable output had been weak.

The year-on-year rise was largely driven by stronger gas burn in Spain, Germany and the Netherlands, which were responsible for almost 500 GWh/d of the 620b GWh/d total increase in aggregate, although gas burn climbed in each of the six markets. Spanish power sector gas burn was particularly strong, lifting domestic gas consumption to a 10-year October high.

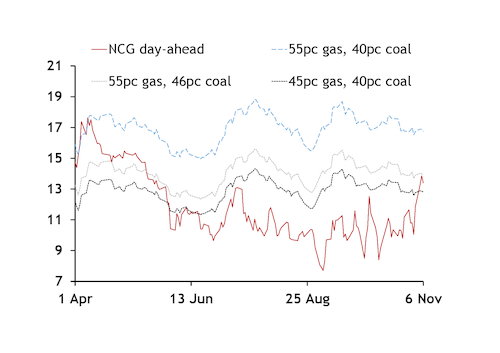

Weaker gas hub prices than in recent years and firm EU emissions trading system (ETS) carbon allowance prices have resulted in gas being much more competitive with coal so far this year, largely driving the rise in power sector gas burn. And regional prompt prices mostly remained deep in fuel-switching territory last month, with Dutch and German prompt prices staying well below the level at which even the oldest 45pc-efficient gas-fired plants could compete with the most modern 46pc-efficient coal-fired plants for most of October.

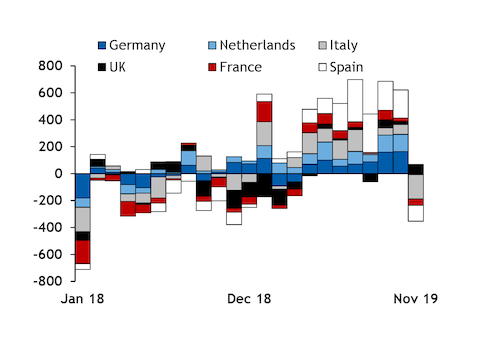

But the 620 GWh/d rise in gas burn was not enough to offset the fall in injections in northwest Europe. Combined injections at German, Dutch and French sites — excluding Norg, which is filled directly from the Groningen field — were only 80 GWh/d in October, down from 968 GWh/d a year earlier.

Aggregate power sector gas burn would have had to climb to more than 3 TWh/d to entirely offset the decline in injections last month. This would have been the strongest for any month since at least January 2011, with the 2.9 TWh/d in January 2017 the next highest.

But power sector gas demand could step up considerably this month from more than 2.4 TWh/d in November 2018, which was the lowest for the month in the past three years. Gas had stayed firmly uncompetitive with coal in November last year, freeing up additional supply for some injections to continue for part of the month.

But gas burn fell early this month, leaving some of the region's most inefficient gas-fired plants further down in the merit order. But TTF and NCG prompt prices were still firmly in fuel-switching territory, with 54pc and 55pc-efficient gas-fired plants in competition with the region's most modern coal-fired plants.

And German lignite-fired plant capacity available to the wholesale power market has fallen from last winter, with more units having been moved into the country's lignite reserve. German utility RWE estimates that a moratorium on further deforestation of the Hambach forest, which is needed to extend the Hambach mine and run the Neurath and Niederaussemen units at full load, would cut power production from the two plants by a combined 5TWh this year.

Gas burn has risen sharply in November from October in most recent years, climbing to more than 2.6 TWh/d in November in the past three years from under 2.3 TWh/d in October. A similar rise this month would lift gas burn to just over 3 TWh/d.

And it could be possible for western European gas burn to rise above 3 TWh/d. Assuming gas burn were to match the highest for each of the six countries since January 2011, combined gas burn could climb to more than 3.2 TWh/d in a month.

Power sector consumption staying high could bolster demand for withdrawals and imports in the coming months.

Injections in northwest Europe on 1-5 November have been quicker than average, but were still minimal, with sites already near capacity. But regasification has jumped, with daily sendout reaching nameplate capacity at some northwest European terminals. Continued brisk deliveries could help provide ample supply for strong power sector gas burn through November, even if the stockdraw remains slow.

07112019041021.jpg)