Although unlikely to outperform other products, the outlook for European gasoline is positive into 2020 as the International Maritime Organisation (IMO) tightens output and transatlantic demand continues to take a greater share of exports. Fundamental changes in the way gasoline is traded are likely to take shape.

The IMO sulphur cap on marine fuels that begins in January 2020 will impact gasoline supply in two ways. First, refineries will seek to increase middle-distillate production over gasoline because of greater demand for marine gasoil and probably higher margins in the middle of the barrel. Second, gasoline will have to compete with the marine bunker pool for feedstocks such as vacuum gasoil (VGO).

Goldman Sachs forecast this month that around 200,000 b/d of gasoline yields will be lost to VGO being diverted to the bunker pool, and another 200,000 b/d because of the shift to diesel production. It represents around 1.5pc of global gasoline demand, at around 26.5mn b/d in 2019, according to the IEA. With global demand forecast to increase by just 74,000 b/d, or 0.3pc, in 2020 by the IEA, next year's wide-ranging IMO regulations will have a significant impact on gasoline.

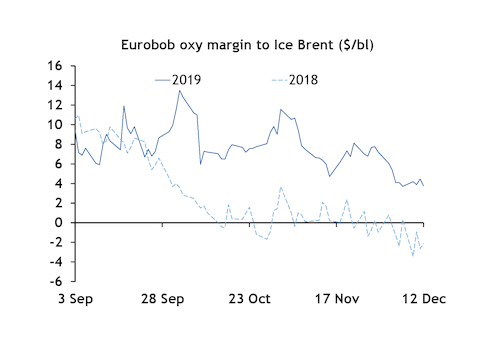

Low-sulphur VGO — used primarily as a feedstock in fluid catalytic crackers to make gasoline — already commands a hefty premium to gasoline, suggesting excess VGO is already being diverted. The high cost of VGO should provide at least a floor to gasoline margins and, at the very least, prevent margins turning negative this winter.

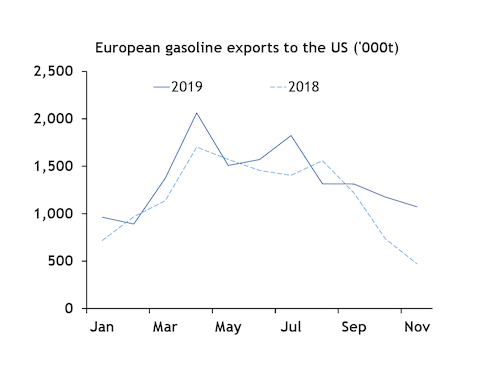

Last year's most significant supply shock will continue to support European gasoline export demand in 2020, namely the closure of Philadelphia Energy Solutions' (PES) 330,000 b/d refinery in June following a fire. Previously the largest refinery on the US Atlantic coast, its absence is estimated to mean an extra 10 transatlantic gasoline cargoes are needed each month. Refinery run rates on the US Atlantic coast are unlikely to recover for some time, averaging just 60-65pc in October and November, according to the EIA.

Monthly gasoline departures from Europe averaged around 1.35mn t between July and November 2019, according to oil analytics firm Vortexa, compared with around 1mn t in the same period of 2018. The difference, around 350,000t each month, is equivalent to around 10 MR-sized vessels.

The lack of domestic refining in west Africa ensures the region will remain Europe's largest export destination, providing a reliable outlet for excess gasoline supplies in 2020 as in 2019. Nigeria alone relies almost entirely on imports to meet its domestic consumption of around 350,000 b/d.

Excess gasoline supply weighed on gasoline margins to crude a year ago, turning them negative for an unprecedented period between December 2018 and February 2019. Refinery upgrades and increased capacity in countries like the US and China should see that trend continue in 2020. Coupled with stagnating European gasoline demand growth, and the region's inherent oversupply of the product, regional producers are likely to have to remain inventive with finding export outlets. But IMO and strong exports should bring much needed balance to the European market.

Gasoline benchmark shakeup

Rising non-oxy gasoline barge volumes in northwest Europe have been stirring debate on the best benchmark for European gasoline.

Non-oxy trades in the Rotterdam barge market outweighed Eurobob oxy barge trading for the first time. It comes after the Netherlands became the sixth EU member to adopt E10 gasoline on 1 October, which uses non-oxy Eurobob — an unfinished gasoline — as its starting point.

Non-oxy Eurobob is more popular with traders because of its flexibility in supplying non-European markets such as the US, but it has been a relatively small market in Europe until now. Argus' Eurobob oxy gasoline assessment is the benchmark for gasoline trade in northwest Europe, but is used primarily for E5 gasoline which produces around 2pc more greenhouse gas emissions than E10.

No change will come overnight, but greater non-oxy liquidity in 2020 will continue to raise questions around the current benchmark, and potentially the biggest shakeup in gasoline trading since Eurobob was introduced in 2009.

By George King Cassell