Sliding crude and diesel prices and slumping demand have raised expectations of a repeat of the base oils price crash during the global financial crisis in 2008.

The prospect of a sharp price correction has exacerbated the recent drop in market liquidity as buyers have held back to avoid exposure to such a scenario. The move has added to the structural slowdown in demand. Transport and industrial activity has already been slowing in all the key markets in a bid to thwart the coronavirus pandemic.

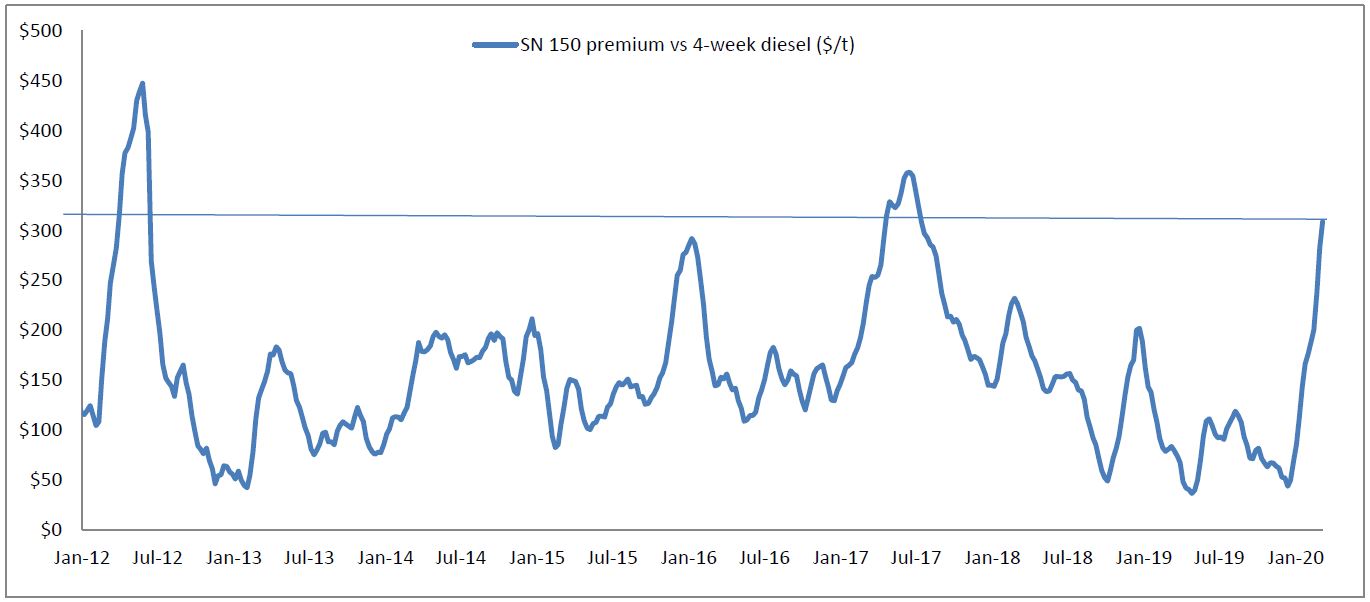

Crude and diesel prices fell by more than 75pc between July 2008 and January 2009. Base oil prices continued to rise for several months during this period. The result was a rise in base oils' premium to crude to more than $700/t by the fourth quarter of 2008 from around $100-150/t in the first half of that year.

The surge in base oil values prompted producers to increase or at least maintain base oils production, adding to supplies. But the surge in values also prompted a growing number of buyers to back off to cover against a price correction. Consumer demand was slowing anyway as global economic growth ebbed.

Base oil prices then crashed by more than $800, or more than 60pc, during a five-month period between late 2008 and early 2009. For a market that coveted stability, the speed and scale of the crash reverberated throughout the industry.

A consequence of the price crash was market moves to prevent such a scenario from happening again. One such move was a request for Argus to start assessing global base oil prices with the aim of providing the market with a price that curbed this kind of risk and volatility. Argus began assessing base oil prices in January 2010. It used a methodology that enabled coverage of market prices even when liquidity thinned.

Crude and diesel prices have again fallen sharply since the start of this year and especially since early March. WTI crude futures fell yesterday to their lowest level since 2002. They are down by more than 65pc since the start of the year. Prices have slumped in response to a global fall in demand. This has coincided with rising crude supplies.

Global base oil values like 2008 have again risen strongly relative to crude and diesel since the start of the year. The premium of light-grade prices over crude rose in March to its highest since 2012. Liquidity has thinned.

But unlike 2008 the market now has access to several price reporting agency price assessments that use different methodologies to assess global base oil market prices. Unlike 2008 outright Argus base oil prices in some markets have been falling since February and in all of them throughout March.

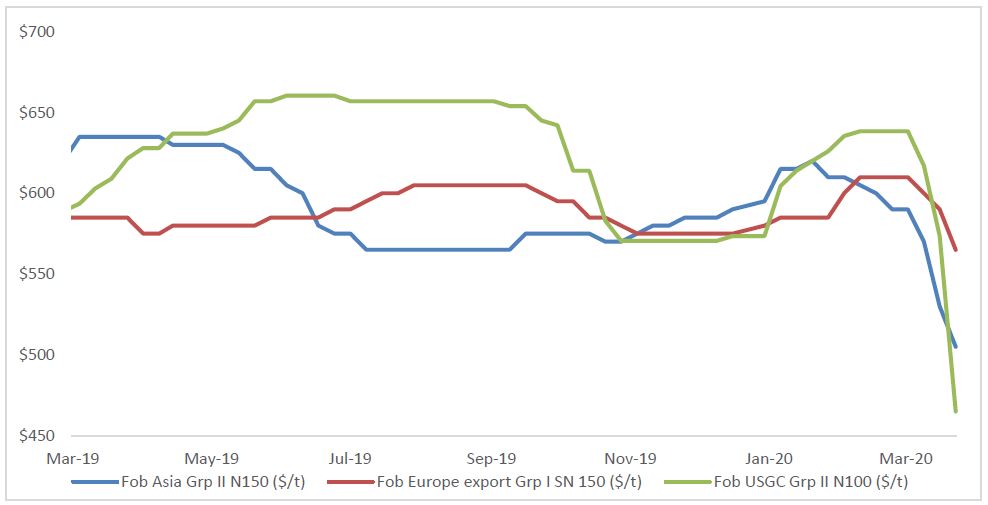

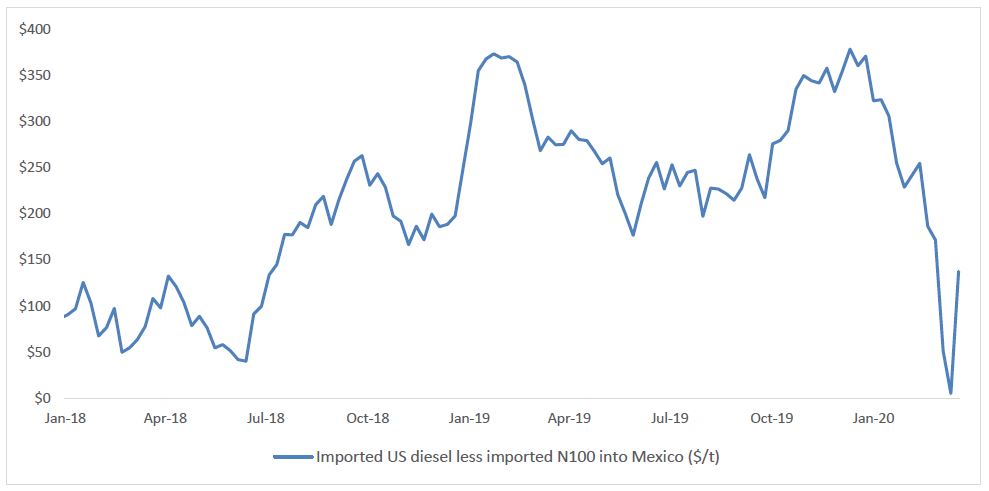

Outright Argus base oil prices have also been falling at a different pace in different markets. The more than $170/t slide in US base oil prices in March alone was larger than the drop in prices in all the other main markets. The price drop reflects the structural slowdown in demand following the closure of the Mexican market to US base oils for blending with diesel.

Group II prices in India also fell sharply in March, by more than $110/t. The coronavirus-related lockdown of the country since 25 March has exacerbated a slowdown in demand after buyers already stepped back to limit exposure to a price crash.

Base oil prices in Asia also fell. The drop was less steep than in US and India. The relative strength reflects firming demand in China and steadier buying interest in southeast Asia.

Prices in Europe have also fallen. But the drop was smaller even than in Asia. Group I producers have had limited surplus supplies for export in recent months. But demand has now slowed in the markets that these supplies are targeting.

Outright base oil prices have fallen. The lower prices reflects a combination of factors, including deals and weakening supply-demand fundamentals. Prices that have reflected rather than lagged the market have eased concerns of a exposure to a sharp price crash. This has helped to sustain market activity and liquidity, curbing the likelihood of a repeat of 2008.