Sliding autogas use is likely to have weighed on one of the worst-hit countries' LPG consumption in March, ending the recent run of growth, writes Tony Cox

South Korean LPG demand began to falter during the early stages of the coronavirus outbreak in the country, after rising to a record high last year. And the rally has probably ended as the pandemic threatens to tip the country into recession.

LPG demand in February fell by 27pc on the month to 9.15mn bl (774,000t). It grew slightly compared with a year earlier but dipped by 0.3pc to 312,000 b/d given the extra day in February, data from South Korean state-controlled oil firm KNOC show. Consumption grew by 9pc on the year in the first two months of 2020 to 358,000 b/d, but this was largely owing to record demand in January.

Similar falls are expected over March, with a South Korean trader estimating that domestic LPG demand dropped by 25pc last month. The impact of the outbreak took hold of the residential and transportation segments in February as the number of cases in the country soared.

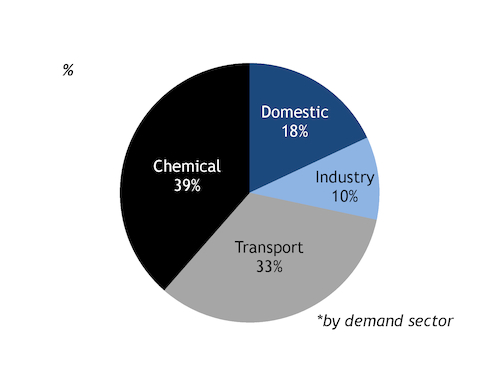

Autogas demand dropped by more than a fifth on the year to less than 72,000 b/d in February. Residential and commercial use fell by 13pc to 57,000 b/d, while industrial demand outweighed the declines, climbing by 18pc to 183,000 b/d, as petrochemicals producers benefited from the dramatic drop in LPG prices.

But even the petrochemical bright spot is waning as South Korea's economy begins to succumb to the effects of the pandemic. Finance minister Hong Nam-ki said in January that the country's economic growth should be unaffected, but that was when the coronavirus outbreak was confined to China. He now concedes that GDP probably contracted in the first quarter of this year, and economists warn of another possible decline in the second quarter, putting the country into recession.

The spread of the coronavirus has slowed sharply in South Korea — the country had around 9,800 confirmed cases and 163 deaths as of 1 April — but the country's export-reliant economy may weaken further before a recovery begins. Exporter sentiment is worse for the second quarter than it is for the first, the Korea International Trade Association (KITA) says.

KITA's exporter survey index is at 79 for the second quarter, a seven-year low. A level of 100 would indicate a neutral outlook relative to the preceding quarter. The most grim segment of respondents was oil products exporters, with an outlook of 59.7. Petrochemicals exporters were also pessimistic, at 89.1, portending lower feedstock demand in the industry.

Cuts and runs

South Korean refiners are being hit hard as the virus saps demand for oil products, forcing executive pay cuts and other cost-cutting measures to reduce losses as operational rates are pared. Gasoline prices have dropped by even more than the cost of crude, resulting in negative crack spreads. Domestic demand for the fuel dropped by 10pc year on year in February to less than 204,000 b/d.

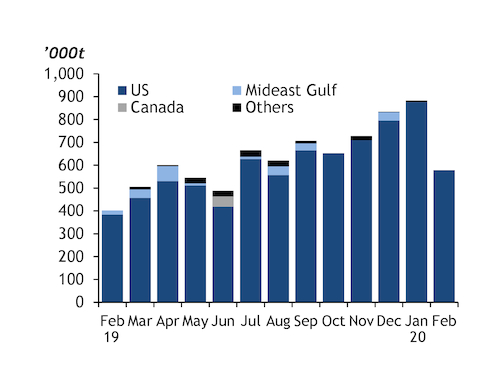

South Korea's propane consumption declined by a fifth on the month to 503,800t and butane by a third to 270,400t in February, KNOC data show. The country imported a third less LPG compared with January, taking 627,000t. Propane imports dropped by 29pc to 520,500t, while butane receipts fell by 47pc to 106,500t.

Domestic LPG production declined by 18pc on the month to 177,600t in February. The country's LPG exports — all propane — dropped by 35pc to 29,920t. Data for South Korea's LPG stocks in February are not yet available, with KNOC scheduling the next release for 20 April.